Summary

Effective and economical expansion of renewable energy for electricity generation is one of the most urgent challenges for addressing climate change. But in many countries, areas that are potentially rich sources of renewables are often located far from the places with the highest demand, such as large urban centers. Investing in transmission lines, as has happened in Chile in recent years and is promised in the 2021 Infrastructure Investment and Jobs Act in the United States, provides a way to achieve greater market integration and promote renewable energy expansion.

Our research examines the impact of linking two major electricity markets in Chile, which were, until 2017, completely separate, with no interconnection between them. Exploring how this market integration changed electricity production, wholesale prices, generation costs, and renewable investments, we find overall that it increased solar generation by nearly 180%, saved generation costs by 8%, and reduced carbon emissions by 5%.

First, we show that prices converge across regions after the complete integration of markets. Before integration, the price difference between the two regions was significant. Market integration substantially reduced this spatial price dispersion by increasing prices in renewable-rich regions and decreasing prices in demand centers.

Second, we find that market integration allowed lower-cost power plants, including renewable energy plants, to increase their production, which replaced production by higher-cost plants. Market integration resulted in a decrease in the cost of electricity generation per megawatt hour.

Third, we find that expectations of investment in renewable energy were triggered around the time of announcement of the construction of the electric transmission line in 2015, even though wholesale electricity prices in renewable-rich regions only increased to a profitable level for renewables after market integration in 2017. This suggests that investors in renewables made their investment decisions based on the anticipation of market integration.

Our analysis indicates that taking account of the investment effects of market integration is key to understanding the benefits of investing in transmission lines. Our result with investment effects suggests that the full impact of market integration on solar power was a 178% increase in generation, compared with a 10% increase if we ignore the investment impact.

Similarly, the static effect resulted in 7% and 3% reductions in the cost of electricity generation per megawatt hour in hour 12 (a solar-intensive hour) and all hours, respectively. If we incorporate investment effects on solar investment, these reductions in generation cost are considerably higher, at 18% and 8%. Furthermore, reductions in environmental externalities provide an additional benefit of market integration.

Our analysis suggests that the cost of transmission expansion can be recovered by 7.2 years with a 5.83% discount rate, and the internal rate of return is 19.7%. These results provide several key implications related to the design of new transmission infrastructures across the world.

Main article

Reducing the carbon emissions from electricity generation by switching to renewable energy sources is a key part of global efforts to tackle climate change. Our research examines how recent grid expansions in the Chilean electricity market changed electricity production, wholesale prices, generation costs, and renewable investments. We find that market integration in Chile increased solar generation by nearly 180%, saved generation costs by 8%, and reduced carbon emissions by 5%. A substantial amount of entry into renewable production would not have occurred without market integration, bringing together renewable-rich regions and demand centers in urban areas through investment in transmission lines.

Effective and economical expansion of renewable energy is one of the most urgent challenges for addressing climate change. Along with the transport sector, the electricity sector generates one of the largest shares of global greenhouse gas emissions. In addition, a significant part of the transport sector is expected to be electrified in the near future. Decarbonizing electricity generation is therefore a critical element of climate action.

A decade ago, the principal challenge for decarbonizing the electricity sector was technological: wind and solar technologies were not cost-competitive with conventional fossil fuels. Today, with costs down dramatically, the challenge that many countries face is how to deliver power from renewable energy to where consumers live.

Division within countries between renewable-rich regions and demand centers discourages investment in renewable power plants.

In many countries, transmission grids were originally built for conventional power plants such as thermal plants, which can be placed reasonably close to demand centers. But areas that are potentially rich sources of renewables are often located far from the places with the highest demand, such as large urban centers. Therefore, with the current transmission network, many countries have a problem of disconnection between renewable-rich regions and demand centers.

Two problems arise from this division between renewable-rich regions and demand centers:

- First, when renewable supply exceeds local demand, electricity system operators have to curtail electricity generation from renewables to avoid system breakdowns, even though curtailment means discarding that is essentially zero-cost, zero-emissions electricity.

- Second, with plentiful, near-zero-cost electricity, the cost of electricity in these regions is very low and sometimes negative. In other words, consumers are being paid to use electricity.

These two problems discourage both new entrants and investment in renewable power plants. Indeed, many countries have started to realize that these problems are among first-order policy questions. For example, the Infrastructure Investment and Jobs Act in the United States, which was signed into law in November 2021, includes significant investment in transmission line expansion and the development, demonstration, and deployment of clean energy technologies.

Investment effects of market integration

So what happens when renewable-rich regions and demand centers are better connected? In Gonzales et al. (2023), we investigate the investment effects of market integration on renewable energy expansion. We begin by developing a simple theoretical model.

Countries seeking to expand their renewable energy sector will need to invest in increased transmission lines.

First, we consider a case in which the assumption is that market integration does not affect producers’ investment decisions. In this case, the value of market integration can be summarized by a conventional definition of gains from trade. Market integration allows lower-cost power plants to export and replaces production from higher-cost power plants, which reduces the overall cost of electricity production.

Second, we consider a model that incorporates potential effects on producers’ investment decisions. If power plants expect market expansion, it provides incentives for them to invest in renewable energy in renewable-abundant regions, thereby shifting the supply curve. With this investment effect, the model predicts that markets can see a larger increase in renewable energy and more savings from market integration.

Empirical evidence from the Chilean electricity market

With this insight, we empirically quantify these theoretical predictions by making use of two large changes that recently occurred in the Chilean electricity market. Until 2017, two major electricity markets in Chile – Sistema Interconectado del Norte Grande (SING) and Sistema Interconectado Central (SIC) – were completely separate, with no interconnection between them.

New interconnections between markets in Chile reduced electricity price dispersion, with rising prices in renewable-rich regions and falling prices in demand centers.

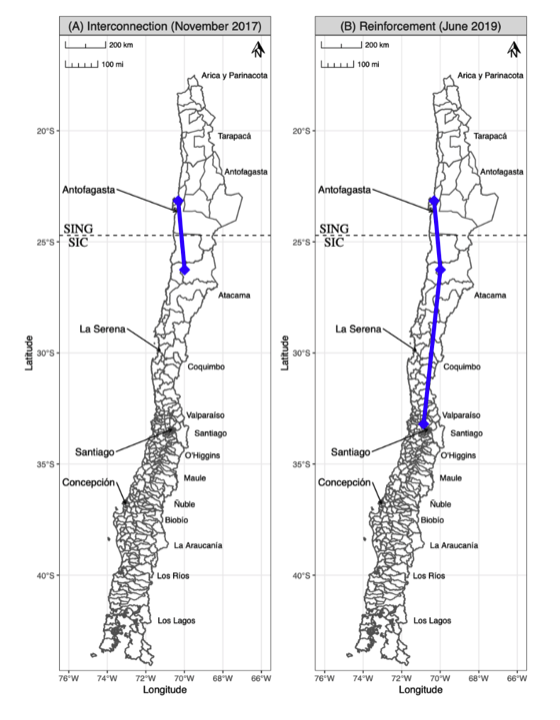

This separation was subsequently recognized as an obstacle to the expansion of renewable energy, as renewable-rich regions (near the Atacama Desert) are located quite far to the north of demand-centered regions (near Santiago, the capital city). To address this problem, the Chilean government completed a new interconnection between these two markets in November 2017, connecting Atacama and Antofagasta (north of Atacama) and an additional reinforcement transmission line in June 2019, connecting Atacama and Santiago (see Figure 1).

What are the effects of market integration?

Aware of accounting for short- and long-term effects, we first look at the immediate effects of the integration of these two markets on wholesale electricity prices, production, costs, and installed capacity of renewable energy.

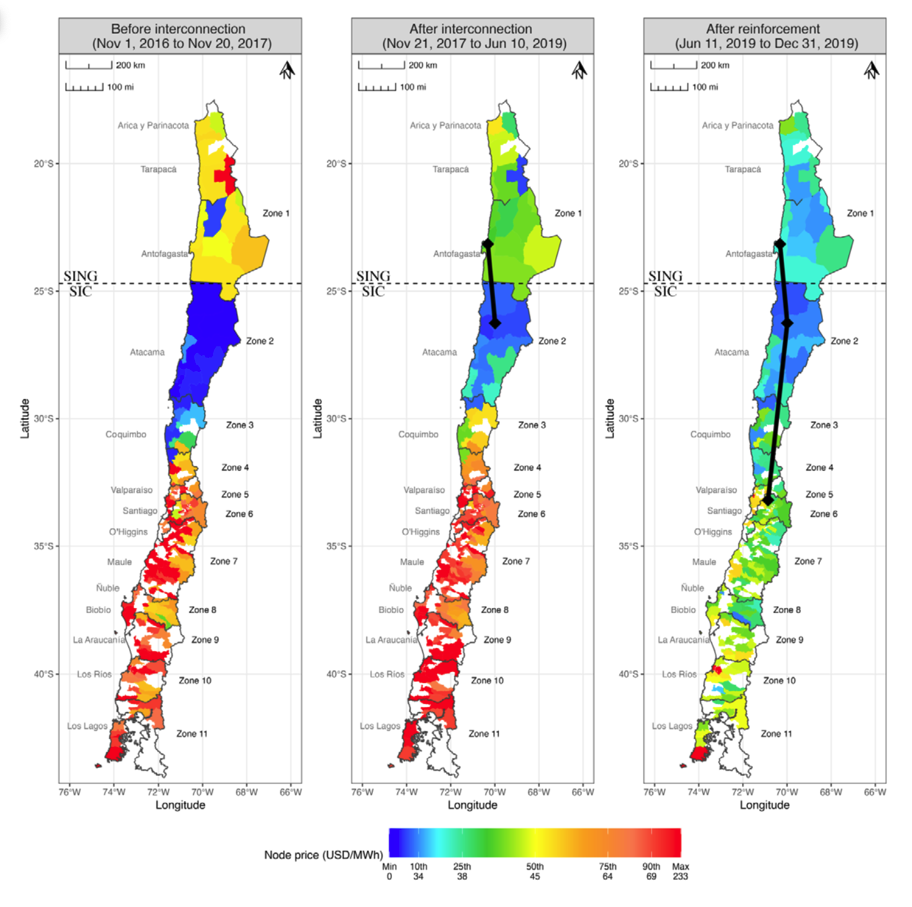

First, we show that prices converge across regions after the complete integration of markets (see Figure 2). Before integration, the price difference between SING and SIC was significant, with some isolated regions where there were curtailment problems, such as the Atacama Desert area. We show that market integration substantially reduced this spatial price dispersion by increasing prices in renewable-rich regions and decreasing prices in demand centers.

Figure 2: The impact of market integration on spatial variation in electricity prices

Notes: These heat maps examine spatial heterogeneity in wholesale electricity prices. We calculate the commune-level average node prices, weighted by the hourly generation at the node level, and make heat maps for three time periods: (1) before the interconnection; (2) after the interconnection but before the reinforcement; and (3) after the reinforcement. We use the percentiles of the node price distribution to define color categories as shown in the legend.

Second, we find that market integration allowed lower-cost power plants, including renewable energy plants, to increase their production, which replaced production by higher-cost plants. We find that the market integration resulted in a decrease in the cost of electricity generation per megawatt hour. This empirical result is in line with the theoretical prediction from gains from trade.

Chile’s market integration allowed lower-cost power plants, including renewable energy plants, to increase their production, replacing production by higher-cost plants.

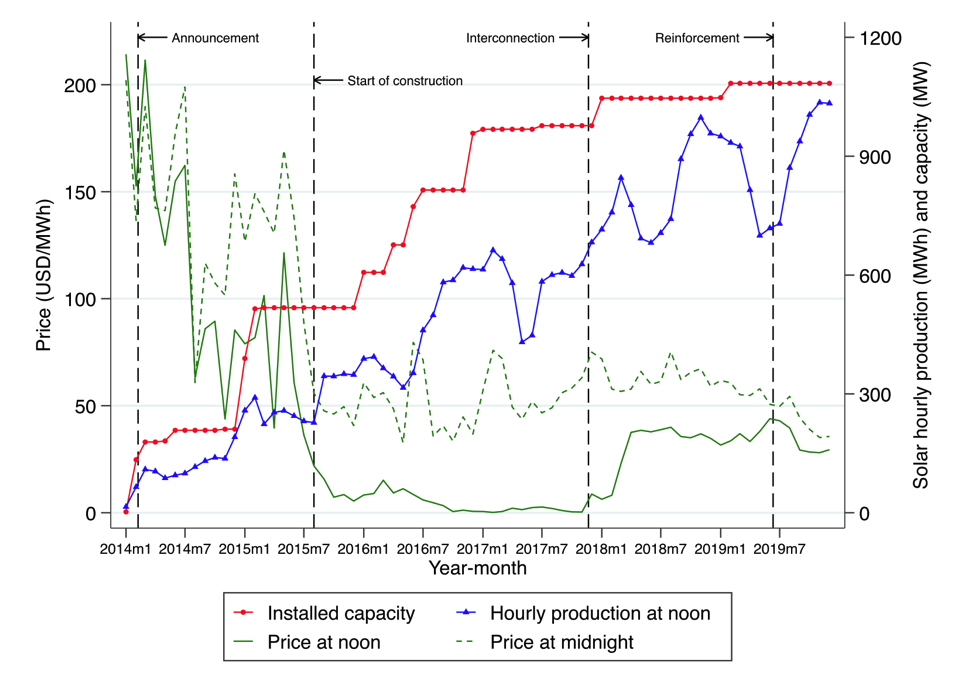

Third, we find that expectations of investment in renewable energy were triggered around the time of announcement of the construction of the electric transmission line in 2015 (see Figure 3). In addition, the wholesale electricity prices in renewable-rich regions were near-zero between 2015 and 2017 (that is, after the announcement of the new transmission line but before the line was open) and increased to a profitable level for renewables only after market integration in 2017.

This evidence suggests that investors in renewables made their investment decisions based on the anticipation of market integration. While investment effects are potentially crucial for understanding the effect of the line, in the presence of anticipation, most of these long-run effects would be missed in empirical evaluation by an event study.

Figure 3: Impacts of market integration on solar expansion

Notes: This figure shows the cumulative installed capacity of solar plants, average hourly generation for each month, and node prices for these plants at noon and midnight in Atacama. We calculate the weighted average node prices using plant-level daily solar generation as weight. As more solar enters around 2014-15, the node price at noon began to decline and reached near zero around 2016. Despite the near-zero market price, solar entry continued, which suggests that this investment was considered to be profitable in the long run with the anticipation of market integration in 2017 and 2019. The ‘announcement’ line shows February 2014, when the Chilean government passed a law that approved the construction of interconnection between SING and SIC. The actual contraction process started in August 2015.

To investigate the potential investment impacts of market integration dealing with these anticipation effects, we build a structural model of power plant entries with renewable investments. In the model, investors consider investment for a new power plant based on the expected value of long-run profit from the investment.

Taking account of the investment effects of market integration suggests that the full impact on solar power plants was a 178% increase in generation.

The net present value of the investment depends on the profit from subsequent years. A key element of the expected future profit is transmission constraints from a local region to other regions. The attractiveness of the Chilean market is that its simple geography makes the network model tractable, and makes it feasible to conduct counterfactual analysis.

We simulate a few counterfactual policies on transmission capacity expansion to examine each policy’s impact on capacity investment in renewables, node prices, profits, and consumer surplus.

The significance of these results

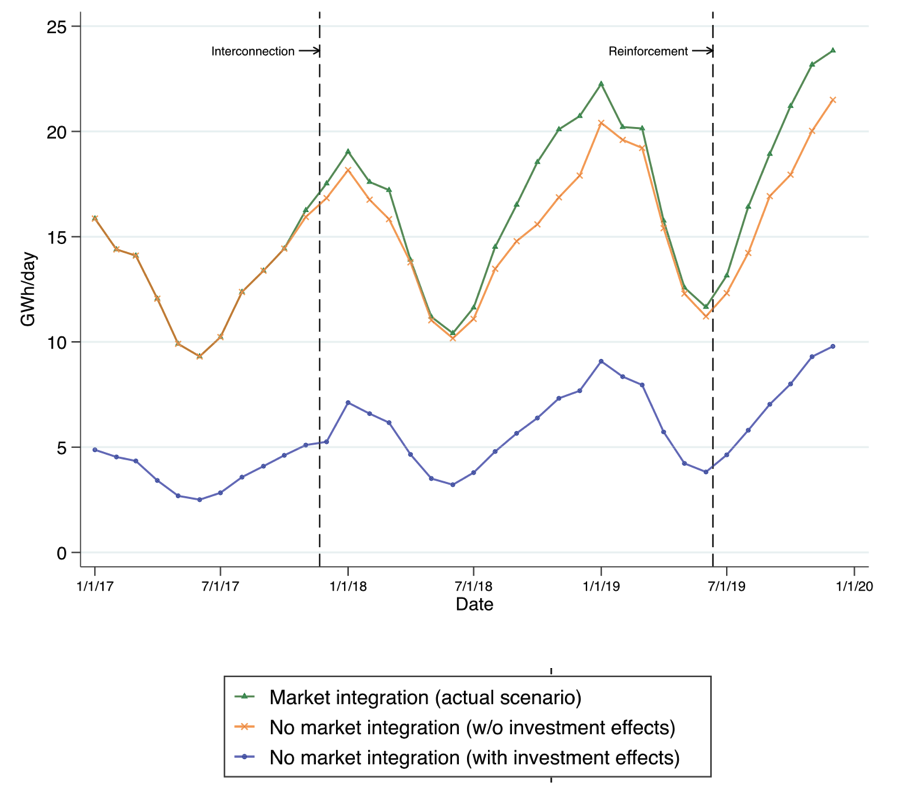

Our counterfactual simulations reveal several findings. First, our result without investment effects suggests that market integration resulted in a 10% increase in solar power generation relative to the counterfactual case with no market integration. This is because in the absence of market integration, the system operator would have had to curtail excessive amounts of solar power due to transmission constraints.

Second, this number understates the impact on solar investment because a substantial amount of solar investment would have become unprofitable without market integration due to low market prices. Our result with investment effects suggests that the full impact of market integration on solar power generation was a 178% increase in generation, compared with the 10% increase if we ignore the investment impact (see Figure 4).

Note: We use our structural model and counterfactual simulations to compute market equilibria for three scenarios. The first scenario is the actual scenario in which market integration happened (the interconnection in November 2017 and the reinforcement in June 2019). The second scenario is a counterfactual case in which the market integration did not happen (no market integration and no investment effects). The third scenario is equivalent to the second but with investment effects – some entry would not happen without market integration because such investments would become unprofitable. The figure shows the monthly average of total daily solar electricity generation (gigawatt hour per day).

For the effects on generation cost, we find that the static effect itself resulted in 7% and 3% reductions in the cost of electricity generation per megawatt hour in hour 12 (a solar-intensive hour) and all hours, respectively. If we incorporate investment effects on solar investment, these reductions in generation cost are considerably higher, at 18% and 8%. Our simulation results also indicate that these impacts play key roles in price convergence across regions.

The cost of transmission expansion can be recovered by 7.2 years with a 5.83% discount rate, and the internal rate of return is 19.7%.

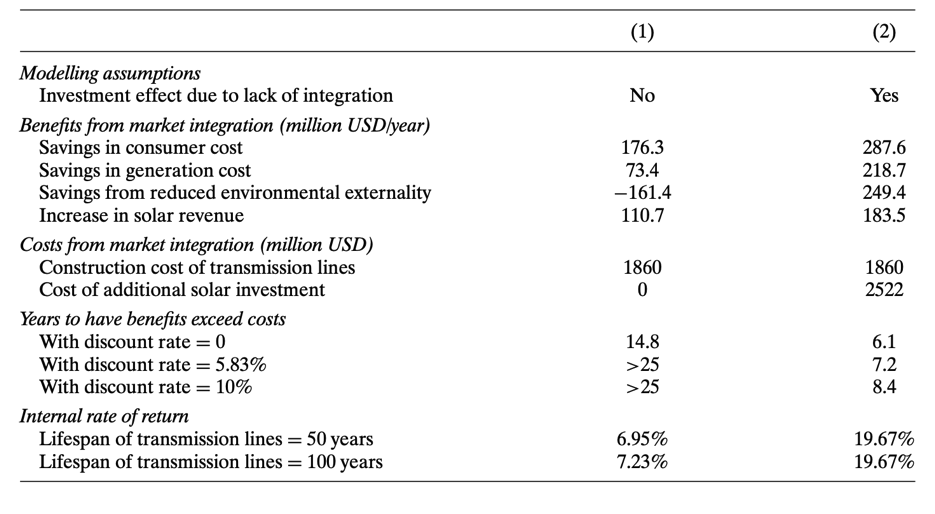

Finally, we use our counterfactual simulation results to conduct a cost-benefit analysis of transmission investments (see Table 1). In particular, we discuss how the cost-benefit calculation can be changed with and without investment effects.

We find that ignoring the investment effects of market integration substantially understates the benefit of transmission investments. Furthermore, reductions in environmental externalities provide an additional benefit of market integration. Our analysis suggests that the cost of transmission expansion can be recovered by 7.2 years with a 5.83% discount rate, and the internal rate of return is 19.7%.

Table 1: Cost-benefit analysis of transmission investments

Note: This table presents different components of the costs and benefits of market integration. The benefits of the transmission lines include (1) savings in consumer cost, which is the product of price and demand, (2) savings in system-level generation cost, (3) monetized savings from reduced environmental externality due to thermal power generation, and (4) increase in total solar revenue in zones 1 and 2. The costs of market integration include the construction cost of the transmission lines and the additional cost of solar investment in zones 1 and 2 (because with investment effects, market integration could lead to higher solar investment). We show the number of years required to recover the cost of market integration under different assumptions of government discount rates as well as the internal rate of returns with different assumptions for the lifespan of transmission lines.

Conclusion

Many countries are seeking to expand their renewable energy sector, and to achieve that, they will need to invest in increased transmission lines. For example, the Biden administration in the United States considers investment in transmission lines and renewable energy to be a key part of the Infrastructure Investment and Jobs Act that was signed into law in November 2021. Our theoretical model and empirical evidence therefore provide several key implications related to the design of new transmission infrastructures across the world.

This article summarizes ‘The Investment Effects of Market Integration: Evidence from Renewable Energy Expansion in Chile’ by Luis E. Gonzales, Koichiro Ito, and Mar Reguant, published in Econometrica in September 2023.

Luis E. Gonzales is at the Central Bank of Chile. Koichiro Ito is at the Harris School of Public Policy, University of Chicago and NBER. Mar Reguant is at IAE-CSIC, Northwestern University, CEPR and NBER.

The views expressed in this article are those of the authors and do not necessarily represent the views of the Central Bank of Chile or its board members.

References

Gonzales, Luis E., Koichiro Ito, and Mar Reguant (2023) ‘The Investment Effects of Market Integration: Evidence from Renewable Energy Expansion in Chile’, Econometrica 91(5): 1659-93.