Summary

Occupational licensing regulations are common across many service sectors, including health, education, transportation, and legal services. The regulations often go much beyond general training requirements and include geographic entry restrictions and price regulations.

Our recent research examines the impact of these regulations by looking at the Latin notary system, under which high-skilled lawyers receive exclusive rights to prepare authentic deeds that certify various important transactions, including, notably, those related to real estate, but also business registrations, marriage contracts and inheritance matters.

We start with a cross-country analysis of several Western European countries. We find that the regulated notary fees are high, and there is a strong bias towards monopoly markets. This provides a first indication that the entry restrictions put a high weight on producer interests.

Next, we provide an in-depth analysis with additional data for one country, Belgium. We show that notary offices tend to have high profit margins, especially for real estate transactions. Furthermore, we show that the current entry restrictions primarily benefit the industry, and hardly take consumer benefits into account.

We use the Belgian data to estimate a demand model for the choice of notary office and individual notary, based on distance and other characteristics, and use this model to evaluate a policy reform that liberalizes the system. Reducing fees for real estate and other transactions would imply strong gains to consumers, without jeopardizing geographic coverage. Liberalizing entry without reducing prices generates substantial gains for consumers and total welfare. Finally, a combination of reducing fees by almost 20% and free entry would maximize total welfare and imply even larger gains for consumers at the expense of the notary firms.

Our research has implications beyond the notary system. It calls for a re-evaluation of occupational licensing regulations in professional service industries, in order to ensure that these policies do not excessively restrict entry into the industry for individuals who have fulfilled the necessary educational requirements. These constraints to entry may often not serve the public interest by correcting market failures but rather protect private industry interests.

Main article

The impact of general occupational requirements has received considerable attention in economic research. Much less is known about the impact of stricter occupational licensing regulations, such as entry restrictions and price regulation, which are common across many service sectors. Our research on the Latin notary system indicates that entry restrictions do not serve the public interest by correcting market failures but instead act to protect private industry interests. These results indicate the need for a re-evaluation of occupational licensing regulations in professional service industries.

Occupational licensing regulations are common across many service sectors, including health, education, transportation, and legal services. These regulations affect up to 20-30% of workers in both the U.S. and Europe, with considerable variation across states and countries; see for example Kleiner and Krueger (2010, 2013) and Koumenta and Pagliero (2019). General education and training requirements to guarantee sufficient quality of supply are often combined with more controversial geographic entry restrictions and price regulations.

Occupational licensing regulations affect up to 20-30% of workers in both the U.S. and Europe.

According to the so-called public interest view, entry restrictions serve to correct market failure such as insufficient quality provision or excessive entry in the presence of market power (e.g., Mankiw and Whinston, 1986). The private interest view instead maintains that entry restrictions are the result of regulatory capture, and serve to maximize industry profits, as in the influential work of Stigler (1971).

The impact of general occupational requirements has received considerable attention in economic research. Theoretical work highlights the role of asymmetric information and moral hazard but also shows that self-regulated quality standards may be too high (e.g., Leland, 1979) or deter consumers with a low willingness to pay (Shapiro, 1986). Empirical evidence confirms that occupational licensing can have negative effects. For example, Kleiner and Soltas (2023) cover a wide range of U.S. occupations and find that licensing raises wages, reduces employment, and implies a net welfare loss.

Comparatively little is known about the impact of geographic entry restrictions and price regulation, which go beyond general occupational licensing requirements.

Much less is known about the impact of occupational licensing that goes beyond general training requirements to include geographic entry restrictions and price regulation. We take up this question in our research on the Latin notary system.

The Latin notary system

Under this system, the state appoints high-skilled lawyer notaries and grants them exclusive rights to prepare authentic deeds that certify various economically important transactions, such as real estate purchases, business registrations, marriage contracts and certain inheritance matters. Their legal services aim to provide the same legal certainty as a court decision.

The system fits in the tradition of legal formalism in civil law countries and is very widespread: it exists in 22 out of the 27 EU countries and in 91 countries worldwide.1 Its size is also economically important: there are at least 40,000 notaries across the 22 EU countries with a notary system, with a total of 160,000 employees. In Belgium, the country that we study in more depth, total sales of the sector amounted to approximately €1.6 billion in 2016, which is comparable to the public budget allotted to law enforcement. Against the background of a broader debate on the costs of legal formalism in civil law countries (e.g., Laporta, Lopez de Silanes and Shleifer, 2008), policy makers have frequently raised concerns that notaries create additional frictions, including reducing residential mobility or impeding the ease of doing business.

In the notary industry, the state places a much higher weight on industry profits than on consumer surplus when issuing new entry licenses.

In almost all countries the notary profession has two distinct features: high, regulated prices (notably on real estate transactions) and regulated entry based on territorial criteria. As such, the system is explicitly designed to eliminate competition with other professions (such as real estate agents, banks, and lawyers), as well as among the notaries themselves. A common justification for these restrictions has been that they ensure the impartiality of notaries, who are tasked with representing the interests of all involved parties, while also fostering sufficient geographic availability. Because the high, regulated prices have been responsible for high profits (about €300,000 per notary per year in Belgium), the notary profession provides an ideal setting within which to study the role of geographic entry restrictions.

Cross-country evidence on entry patterns

We first provide cross-country evidence regarding the fee structure and distribution of licenses in a selection of Western European countries: Austria, Belgium, France, Germany, Italy, the Netherlands, Portugal, and Spain. In most of these countries, the regulated fees are very high. For example, in 2018 the fee for certifying a house purchase worth €250,000 with a 70% mortgage amounted to €3,050 in France, €3,300 in Belgium and €5,100 in Italy. We study the local entry patterns within each country, comparing the number of licensed notaries in a municipality to population and other local market demographics. We find a considerable bias towards monopoly markets. In France, for example, it takes on average 6,500 inhabitants to see the first notary office, and almost 16,000 inhabitants to see the allocation of a second license, and 33,000 inhabitants for a third license. Given the strict price regulation, these findings provide a first indication that the entry restrictions put a high weight on industry profits.

Firm-level analysis of the Belgian notary sector

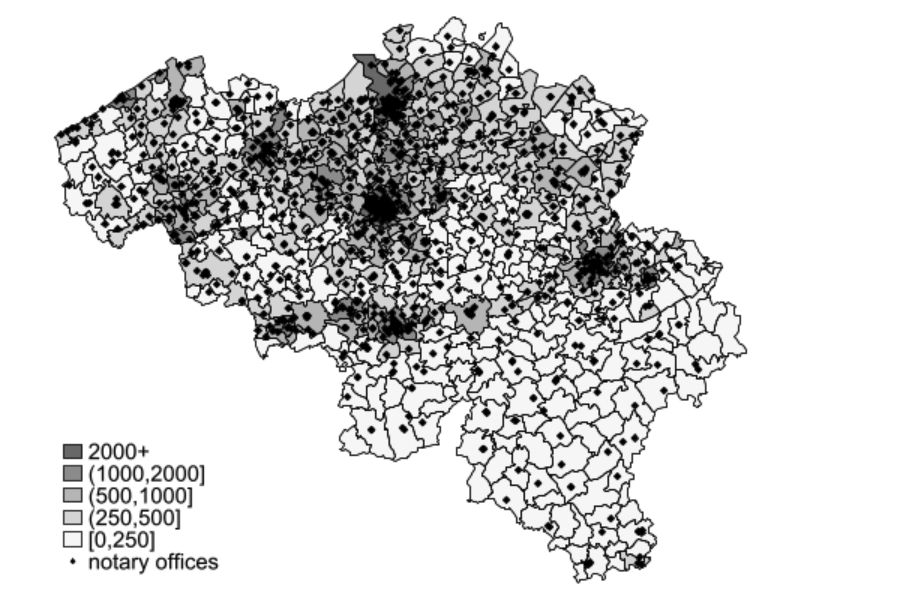

To explore this further, we provide a more in-depth analysis with firm-level data for Belgium. Figure 1 shows the distribution of notary offices in the country in 2016. A total of 1,152 notary offices were active, hosting 1,569 individual notaries. For each firm, we collected information on the number of real estate and other transactions, the number of employees, and financial information such as net added value, labor costs, and other input costs.

Reducing fees for real estate and other transactions would imply strong gains to consumers, without jeopardizing geographic coverage.

This data allows us to estimate a demand model for the choice of notary office and individual notary, based on distance and other characteristics. Our findings indicate that consumers value notary proximity. Although an additional notary office leads to substantial business stealing from other nearby offices, it also creates some modest market expansion, which implies that consumers perceive the current availability of notaries as too restrictive. This finding is consistent with other evidence on notary shortages, and indicates that consumers would greatly benefit from additional notaries. Furthermore, information on firms’ wage bill and spending on intermediate inputs allows us to estimate firm production costs. The current regulated fees are substantially higher than marginal and average variable costs. Markups are especially high for real estate transactions.

Figure 1: Firm locations and population density (inhabitants per km2)

Entry restrictions may often not serve the public interest by correcting market failures but rather protect private industry interests.

Having estimated consumer surplus and firm variable profits, we then introduce an entry model to understand the state’s objective function when allocating the restricted number of licenses across the country. The model enables us to uncover both the fixed costs of additional entry and the weight that the state attaches to producers and consumers. We show that the state places a much higher weight on industry profits than on consumer surplus when issuing new entry licenses. Intuitively, allowing additional entry would substantially raise overall welfare because the consumers’ value from additional notaries outweighs the duplication of fixed costs.

Counterfactuals: policy reform

To obtain further insights into the current economic distortions, we use the model to perform various policy counterfactuals. In a simplified first step, we focus on reforming fees to make them more cost-oriented, while keeping the current geographic entry distribution fixed. There is considerable scope for reducing the regulated fees without jeopardizing geographic coverage. For example, reducing the regulated fees by 16% (23%) still guarantees net industry profits of €200 million (€100 million), and would make only 2 (22) out of the 1,152 notary offices unprofitable. The maps in Figure 2 illustrate these findings, as there are only a few white or light gray spots with net profits below €100,000 per notary office. Although such fee reductions would result in limited gains in total welfare (the sum of consumer and producer surplus), they would entail a substantial transfer from notary firms to consumers.

Figure 2: Average office-level profits under alternative fee structures (in €1000)

In a second step, we consider deeper reforms that also loosen the geographic entry restrictions. Motivated by a large available pool of specialized graduates, we assume that all new entrants can still satisfy the current strict educational and experience requirements. As such, we assume that entry liberalization would preserve quality and public trust in the notary function.

Our research calls for a re-evaluation of occupational licensing regulations in professional service industries.

We consider both welfare-maximizing entry and a full liberalization, which would allow free entry. We summarize our findings in Table 1. Keeping the current fees constant, the welfare maximizing number of firms would be more than twice the current number, increasing from 1,152 to 3,522. This implies substantial potential welfare gains of €463 million, as the consumer surplus gains (€552 million) significantly outweigh the losses in industry profits. A full liberalization, which would allow free entry without adjusting fees, would also raise welfare, but by the lower amount of €376 million. This decrease in welfare gains is because at the current high prices there is excessive free entry.

| Table 1: Counterfactual equilibria under alternative regulatory regimes | ||||||

| # notaries | # offices | uncovered markets | change in consumer surplus | change in producer surplus | change in total welfare | |

| Current entry outcome | ||||||

| 1569 | 1152 | 104 | – | – | – | |

| Outcome after entry reform – keeping current prices constant | ||||||

| welfare maximizing entry | 4439 | 3522 | 5 | 552 | -89 | 463 |

| free entry | 8066 | 3434 | 9 | 749 | -373 | 376 |

| Outcome after entry reform – optimal 17-19% price reduction | ||||||

| welfare maximizing entry | 4307 | 3306 | 22 | 835 | -347 | 488 |

| free entry | 4197 | 3195 | 33 | 859 | -374 | 485 |

Additional interesting insights are obtained if entry liberalization is combined with a reduction in the regulated fees. If free entry is accompanied by a 19% fee reduction, this would result in an outcome close to the first best. In other words, reducing fees serves as an additional regulatory instrument to prevent excessive free entry. Free entry combined with a 19% fee reduction would also entail a substantial redistribution from firms towards consumers (who gain €859 million), without threatening geographic coverage.

Conclusion

The notary system is common in many civil law countries. It has been criticized for creating frictions such as reducing residential mobility and impeding the ease of doing business. But even if these frictions are acceptable to create legal certainty on important economic transactions, our research shows that the system itself is in need of reform. The high, regulated fees and tight geographic entry restrictions primarily serve the industry’s interests, in line with Stigler’s theory of regulatory capture. A reform that both reduces fees and liberalizes entry would imply considerable welfare gains and would particularly benefit consumers without creating a risk of reduced geographic coverage.

Our findings are also relevant for occupational licensing in many other professional services sectors with regulated fees and/or entry restrictions.

This article summarizes ‘Private Monopoly and Restricted Entry—Evidence from the Notary Profession’ by Frank Verboven and Biliana Yontcheva, published in the Journal of Political Economy in November 2024.

Frank Verboven is at KU Leuven and Biliana Yontcheva is at the University of Hamburg.

References

Kleiner, M. M. and Krueger, A. B. (2010). The prevalence and effects of occupational licensing. British Journal of Industrial Relations, 48(4):676–687.

Kleiner, M. M. and Krueger, A. B. (2013). Analyzing the extent and influence of occupational licensing on the labor market. Journal of Labor Economics, 31(S1):S173–S202.

Kleiner, M. M., & Soltas, E. J. (2023). A welfare analysis of occupational licensing in US states. Review of Economic Studies, 90(5), 2481-2516.

Koumenta, M. and Pagliero, M. (2019). Occupational regulation in the European Union: coverage and wage effects. British Journal of Industrial Relations, 57(4):818–849.

Leland, H. E. (1979). Quacks, lemons, and licensing: A theory of minimum quality standards. Journal of Political Economy, 87(6):1328–1346.

Mankiw, N. G. and Whinston, M. D. (1986). Free entry and social inefficiency. RAND Journal of Economics, pages 48–58.

Stigler, G. J. (1971). The theory of economic regulation. The Bell Journal of Economics and Management Science, pages 3–21.

1 The system does not exist in common law countries. The so-called “notary public” in the U.S. and Canada has a much smaller role. The notary public does not provide legal services but performs routine tasks at a very low cost (such as administering oaths or authenticating certain documents).