Do social safety net programs bring long-term gains for those using them? A new study considers the rollout of the US Food Stamps program, which provides food vouchers to low-income families. This became a key part of the US safety net during the War on Poverty in the 1960s. The researchers take advantage of the staggered rollout, which meant that only some children born in a given year were exposed to the program, depending on where they lived. By linking various data sets, the researchers examine whether children exposed to the program have done relatively well in later life. The researchers find gains in outcomes including educational attainment, economic self-sufficiency, neighborhood quality, higher rates of survival, and lower rates of incarceration. Where safety net programs yield long-term gains, estimates of these are essential when governments weigh the costs and benefits of spending. As well as helping people on low incomes to meet their current needs, the safety net can also be a long-term investment.

Social safety net programs are designed to help people with low incomes meet their food, housing, and healthcare needs. Dating to President Lyndon B. Johnson’s War on Poverty in the US, the objective of these programs is “not only to relieve the symptom of poverty, but to cure it and, above all, to prevent it.” In 1964, the War on Poverty turned the Food Stamps program into a core component of the US social safety net. Now called the Supplemental Nutrition Assistance Program (SNAP), it provides food vouchers to low-income families. These vouchers supplement their grocery budget to help reduce food insecurity and improve health and wellbeing.

Today, SNAP remains the second largest anti-poverty program for children and the most important program for reducing deep child poverty. In 2022, SNAP raised 3.7 million people out of poverty. Food Stamps also supported millions of families affected by the Covid-19 pandemic, in which adults lost jobs and, as a result of school closures, children lost access to food delivered through school breakfast and lunch programs. Children accounted for 22 percent of all poor people in the US in 2022, making them important beneficiaries of the overall social safety net, and SNAP in particular.

Evidence shows that the program achieved its first objective – relieving the symptoms of poverty – by raising food spending among participating families and improving infant health. But the extent to which SNAP can achieve its second objective, preventing poverty in the future, has been hard to study. What are the lasting effects of access to the Food Stamps program? Do potential long-term effects depend on the child’s age when their family gained access to the program? And what aspects of adult well-being are most affected by childhood exposure to Food Stamps? Understanding the long-run benefits matters for government spending decisions: if these programs improve adult economic well-being, generating both private returns and public benefits, then the social safety net could lead to a “return on investment” and may help to pay for itself.

Children accounted for 22 percent of all poor people in the US in 2022, making them important beneficiaries of the overall social safety net, and SNAP in particular.

Our recent research paper quantifies the lasting effects of childhood access to Food Stamps on a wide range of adult outcomes. These include educational attainment, economic self-sufficiency, neighborhood quality, disability, incarceration, and mortality. We combine three large US administrative datasets: the Decennial Census, American Community Surveys, and the Social Security Administration’s Numident. This means we can measure access to the program in childhood for large numbers of people, so that we can detect even long-term impacts.

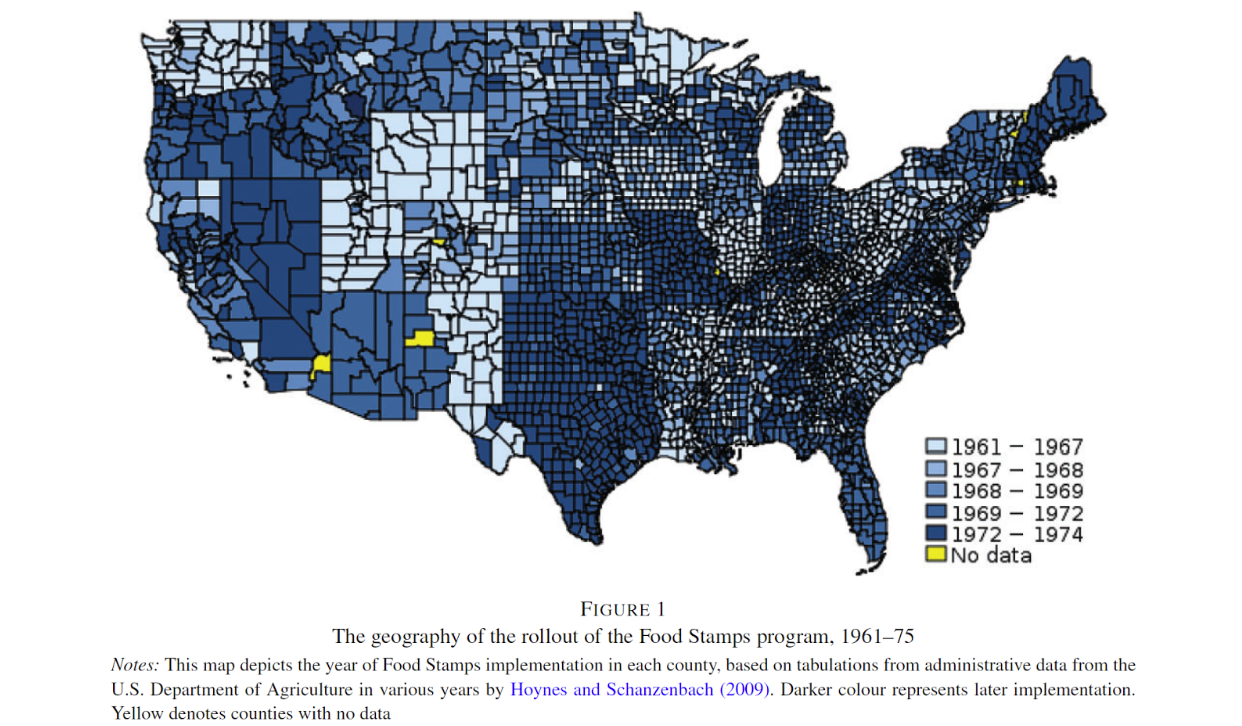

Most US counties first implemented the program at some point between 1961 and 1974; see Figure 1. We measure access based on the year in which a county began operating the program. In this period, children born in a given year were first exposed to the program at different ages, depending on where they lived. Our analysis of the data uses these differences, by county and age at exposure, to examine the effects of the program; we can compare children first exposed at earlier ages (and therefore for longer) with children born in the same year and first exposed at older ages. Drawing on this approach, we use several different statistical analyses to quantify the effects of the Food Stamps Program, including event study approaches and “linear spline” models.

Figure 1

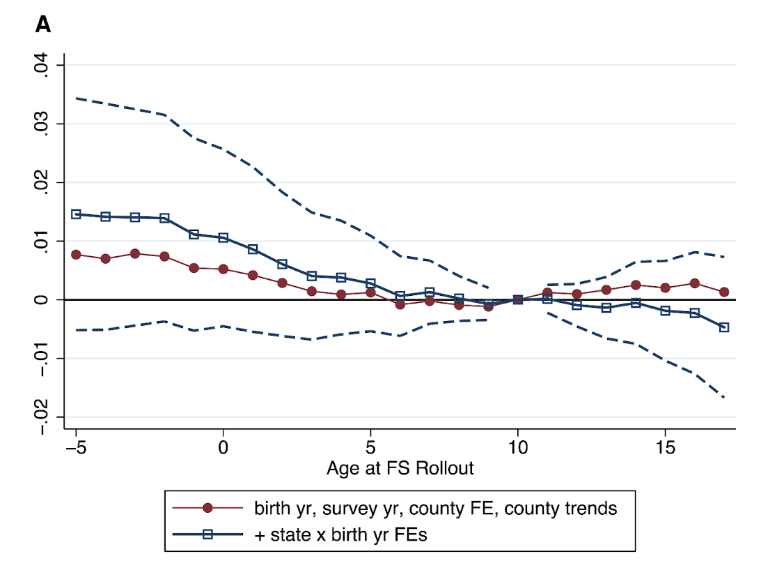

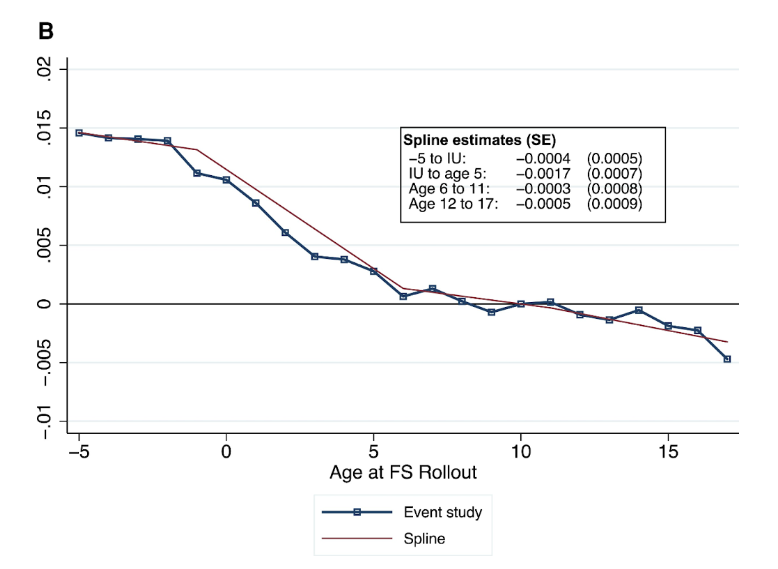

Both panels in Figure 2 show our “intent-to-treat” estimates in standard deviation units of a composite index of well-being (y-axis). The composite index is an average of four subindices. The first is a productivity and human capital index which captures educational attainment and occupational status. The second is an economic self-sufficiency index which is based on labor-force participation, work hours, labor income and depends negatively on public source income. The third is a neighborhood quality index which captures living amenities outside of income and work-related outcomes. The fourth is a physical ability and health index. Movement along the x-axis from right to left represents earlier (and hence longer) exposure to Food Stamps in childhood. Negative values on the x-axis represent children who were conceived after Food Stamps had already been implemented in their county, and consequently were exposed to the program throughout their life. The results show that more years of access to Food Stamps in early childhood, between conception and age 5, had lasting effects on adult well-being. For later ages, 6-18 years, we found that exposure to Food Stamps had smaller effects on later outcomes, with an important exception. For nonwhite males, we found that exposure to Food Stamps throughout childhood, including at ages 6-18, significantly reduced the likelihood of adult incarceration.

Figure 2

Intention-to-treat event-study and spline estimates of effects of Food Stamps, by age of cohort when the program launched. Panel A. Composite Index, event-study estimates. Panel B. Composite Index, four-part spline Notes: The two panels plot event-study and linear spline estimates (equations 1 and 2, respectively) using the composite standardized index as the outcome. The sample includes more than 17 million US individuals born in the US between 1950 and 1980 who are observed in the 2000 Census one-in-six sample and 2001-13 ACS merged to the SSA’s NUMIDENT file using PIKs. The regressions are estimated on data collapsed into birth-county × birth-year × survey-year cells, and weighted using the number of observations per cell. Standard errors clustered at the birth-county level. All regressions include birth-year, survey-year, and birth-county “fixed effects” to control for variation specific to these categories. They also include 1960 county characteristics interacted with a linear trend. Panel A presents two sets of estimates, with and without birth-state × birth-year fixed effects, in squares and red circles, respectively. The dashed lines show the 95% confidence intervals from the model that includes birth-state × birth-year fixed effects. In panel B, we overlay the event-study estimates, from our preferred specification with birth-state × birth-year fixed effects, with the linear spline estimates depicted using the solid line. The estimates of the slopes of each spline segment are presented in the box on the graph. See text of our full paper for more details on the construction of the sample and the outcome.

The results show that early life exposure had large and statistically significant effects on later-life outcomes.

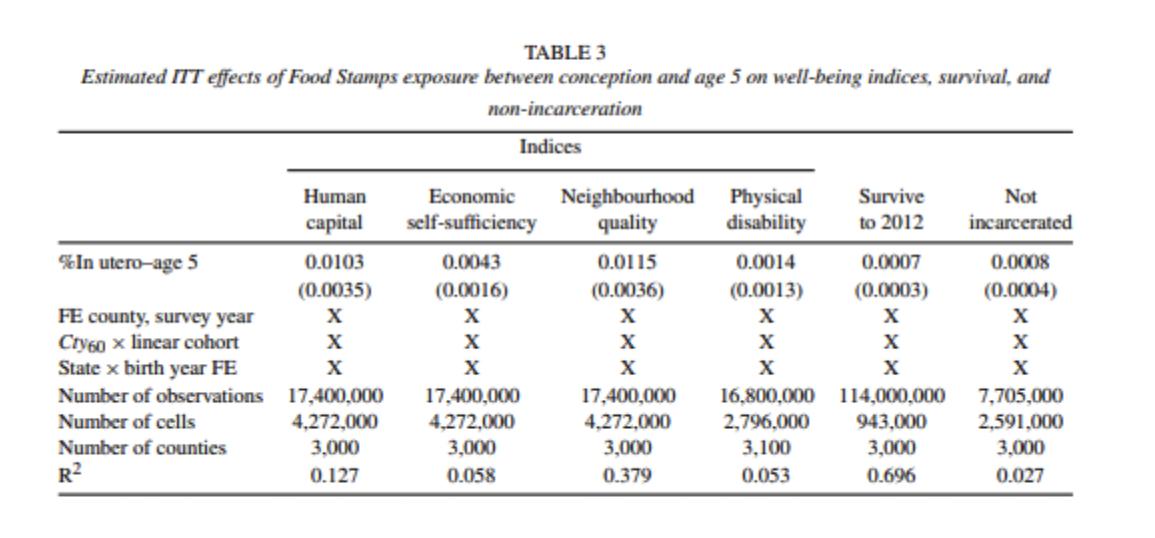

We also estimate “difference-in-differences” models. These use cumulative exposure before age five to measure the “dose” of the program. We calculate the share of months each cohort was exposed to Food Stamps, using the month and year the program began in each county and the approximate month of conception. Table 1 presents estimates of difference-in-differences models. The results show that early life exposure had large and statistically significant effects on later-life outcomes, including adult human capital (column 1), economic self-sufficiency (column 2), neighborhood quality (column 3), survival (column 5) and incarceration (column 6).

Table 1

For example, an increase in Food Stamps in early childhood leads to increases in educational attainment through college graduation (a sub-index component of human capital). Food Stamps exposure has positive and significant impacts on earnings, a family’s income-to-poverty ratio, and the likelihood of not being in poverty; these are sub-index components of economic self-sufficiency. It also leads to a large increase in the likelihood of home ownership and an overall improvement in the quality of the adult neighborhood of residence, as measured by mean income, child poverty rates, teen pregnancy rates, single-headship of one’s neighbors, and relocation to better places; these are sub-index components of neighborhood quality.

Several pieces of evidence suggest that our results are likely to be valid. First, previous research shows that the timing of the Food Stamps rollout across counties is not correlated with other county time-varying determinants – such as prior existence of the Commodity Distribution Program, or the launch of Community Health Centers or Head Start – of our long-term outcomes of interest. Second, we run several tests to examine the robustness of our findings. These include testing the sensitivity of our estimates to adding additional controls, pre-trend tests, and relying only on within-state variation in program rollout.

Since the program had many long-term, positive effects, there is likely to be more than one channel driving them. For example, a back-of-the-envelope calculation suggests that the increase in adult earnings is unlikely to be entirely explained by the increase in educational attainment. Also noteworthy, the effects sometimes vary by race, sex, and geographic mobility. The effects for nonwhites, who represent just 15% of the overall sample, are harder to measure precisely given their smaller numbers. We find little evidence of a positive effect on physical health (column 4 of Table 1), except for nonwhite men. Many of the benefits for human capital outcomes are concentrated among white individuals, while the gains in longevity are concentrated among nonwhite individuals. Reductions in incarceration are associated with nonwhite males in particular. Indeed, these findings on incarceration and mortality suggest that improvements in other determinants of long-term earnings, such as non-cognitive skills and health, also play a role.

Since the program seems to have many positive effects, there is likely to be more than one channel driving the long-term effects of Food Stamps.

Overall, our results show that access to Food Stamps in one’s county of birth, in utero through age 5, helped to improve adult well-being. Not only do we find direct gains for children exposed to the program, some of these gains may have led to intergenerational impacts, on the children of the children who benefited from the program’s rollout.

What do our findings imply for current debates about the social safety net? SNAP is one of the largest US programs of its kind, and the only safety net program available to nearly all income-eligible families (other programs limit eligibility to particular subgroups based on age, disability status, or household structure. The Food Stamps program also plays an important “countercyclical” role when the economy deteriorates, by automatically increasing benefits as need increases. The program greatly helped in protecting families from income loss in the Great Recession and during the Covid-19 pandemic. Our findings are important in developing credible and comprehensive estimates of the program’s long-term impacts. This part of the safety net brings long-term gains, and estimates of these are essential when governments make budgetary decisions by weighing up costs and benefits.

This article summarizes ‘Is the Social Safety Net a Long-Term Investment? Large-Scale Evidence from the Food Stamps Program’ by Martha J. Bailey, Hilary Hoynes, Maya Rossin-Slater, and Reed Walker, in the Review of Economic Studies. Martha Bailey is a Professor of Economics at UCLA. Hilary Hoynes is Professor of Economics and Public Policy at UC Berkeley. Maya Rossin-Slater is an Associate Professor in the Department of Health Policy at Stanford University School of Medicine. Reed Walker is an Associate Professor of Business and Public Policy and Economics at UC Berkeley.