Summary

Cash transfer programs have become increasingly popular in developing countries over the past twenty years as they have proved successful at alleviating poverty in both the short run and, in some cases, the long run. From their inception, however, these programs have raised concerns that a portion of the associated transfers could be appropriated by shopkeepers through price increases, thereby reducing their beneficial effect on households’ resources. Many studies have analyzed the effect of cash transfers on the average unit prices of goods and services, and the consensus so far has been that programs have not had appreciable effects on prices.

In a paper published in Econometrica in 2020 titled “Nonlinear Pricing in Village Economies”, we show that price discrimination is rife in markets for staple food in rural Mexico. Households do not face a constant unit price for a good, but instead substantially lower prices per kilogram for the purchase of larger amounts. Sellers are therefore price discriminating among consumers through nonlinear pricing in the form of quantity discounts. The logic here is simple. When consumers differ in their intensity of preference for a good, a seller has an incentive to sell lower quantities of a good at higher unit prices to induce consumers who like the good relatively more to purchase more of it.

The effects of this type of price discrimination on the consumption of poor households are often misunderstood. That poor households pay higher unit prices than rich households is usually interpreted to imply that nonlinear pricing leads to undesirably low levels of consumption among the poor. Using a rich model of price discrimination that we propose, which accounts for many distinguishing features of markets in developing countries, however, we find that many poorer households consume much more than they would have under linear pricing. Depending on the good considered, we estimate that between 20 percent and 70 percent of households who purchase the smallest quantities would be excluded from the market under linear pricing. It appears, therefore, that price discrimination can be less detrimental for consumers than often thought.

We also find that the presence of price discrimination has crucial implications for the impact of cash transfer programs. We document that average unit prices in rural Mexico barely changed after the introduction of the Progresa cash transfer program, but that the unit prices of small quantities of common staples purchased by poorer households increased, whereas the unit prices of large quantities of the same goods purchased by richer households decreased. From this we conclude, therefore, that income transfers can have adverse price effects for the most vulnerable segments of consumers when markets are imperfectly competitive, which can reduce their intended benefits.

Our theoretical and empirical work provides a first step towards performing much-needed further analysis of how market power on the part of sellers affects the distributional impact of income transfers and similar poverty alleviation programs.

More work is also needed to understand the long-run impact of these programs on the structure of markets. The introduction of transfers may lead in time to the entry of additional sellers and so to an increase in the degree of market competition, which would be particularly beneficial to poor consumers.

Main article

Many studies analyzing the effect of cash transfers on prices have focused on average unit prices and documented no effect. We find, however, that price discrimination in the form of quantity discounts is rife for staple food in rural Mexico, which makes looking at average unit prices—which barely changed after the introduction of the Progresa cash transfer program—misleading. We document that the unit prices of small quantities of common staples increased, whereas the unit prices of large quantities decreased. Cash transfers therefore had substantial price effects that disproportionately affected poor households. But we also find that quantity discounts can be less detrimental for consumers than often thought. In particular, the imposition of a constant unit price —say, by regulation— might end up excluding some households from the market.

Cash transfer programs have become increasingly popular in developing countries over the past twenty years. Recently, World Bank researchers have documented a dramatic expansion of such programs to address the Covid-19 crisis. The reason for the popularity of these programs is that they have proved successful at alleviating poverty in both the short run, by transferring resources to families, and, in some cases, the long run, by encouraging parents to invest in the health and education of children. Their beneficial long-run effects are most pronounced when transfers are conditional on specific eligibility requirements. These so-called conditional cash transfer programs or CCTs are typically paid by the government. Transfers target eligible families for as long as they satisfy certain conditions that support development goals, such as immunizing children or keeping them in school.

From their inception, however, these programs have raised concerns that a portion of the associated transfers, especially in isolated rural communities, could be appropriated by shopkeepers through price increases, thereby reducing, if not potentially erasing, their beneficial effect on households’ resources. Intuitively, when consumers receive additional income, sellers with market power have an incentive to adjust offered quantities and prices in response to consumers’ higher ability to pay in order to increase their profits.

Cash transfer programs have proved successful at alleviating poverty in both the short and the long run.

Accordingly, several studies have analyzed the effect of cash transfers on the average unit prices of goods and services. In the case of the celebrated Mexican CCT program Progresa (subsequently known as Oportunidates and finally as Prospera) launched in 1997 with the aim of improving education, health, and nutrition in poor rural villages, studies that investigated its price effects concluded that the program did not lead to higher local unit prices. Hence, the consensus has been that Progresa, much like many other similar programs, has not had appreciable effects on prices.

We argue that this conclusion might be unwarranted, as it ignores an important feature of markets for even the most common staples in developing countries: price discrimination, often in the form of unit prices declining with quantity or quantity discounts, is pervasive. For example, differences in the prices paid by poor and rich households have been documented for drinking water in the Philippines (McIntosh, 2003), and for healthcare and health services in Thailand (Pannarunothai and Mills, 1997) and Sierra Leone (Fabricant, Kamara, and Mills, 1999). Differences in the prices of basic food staples paid by poor and rich households, resulting from poor households buying smaller quantities, have been reported for villages in India (Rao, 2000) and Colombia (Attanasio and Frayne, 2006).

In a paper published in Econometrica in 2020 titled “Nonlinear Pricing in Village Economies”, we find that price discrimination through quantity discounts is common in rural Mexico as well. The local unit prices of food items like rice, beans, and sugar are much higher for small quantities than for large quantities, making average unit prices uninformative about the actual prices that different households pay for the different quantities they purchase.

A number of studies analyzing the effect of cash transfers on the average unit prices of goods have found no effect.

As we discuss below, the effects of this type of price discrimination on the consumption of poor households are often misunderstood. Moreover, and importantly in the context we have analyzed, the presence of price discrimination has crucial—and generally overlooked—implications for the ultimate impact of cash transfer programs. We document that although average unit prices barely changed after the introduction of Progresa, the unit prices of small quantities of common staples purchased by poorer households increased, whereas the unit prices of large quantities of the same goods purchased by richer households decreased. Hence, cash transfers have had substantial price effects that disproportionately hurt poor households.

What the Existing Literature Has Missed in Evaluating Cash Transfers

The main reason why our conclusions differ from those reached by the existing literature is that we explicitly take into account key features of sellers’ pricing behavior. The markets we study are highly noncompetitive — a few sellers exert market power by price discriminating among consumers. That is, sellers do not set a constant unit price for a good and let consumers buy as much as they desire at this price. Rather, sellers effectively offer price schedules, charging substantially lower prices per kilogram for larger amounts purchased. Whenever a seller sets a price per unit of a good that declines with the amount purchased, a seller is said to be price discriminating among consumers through nonlinear pricing in the form of quantity discounts.

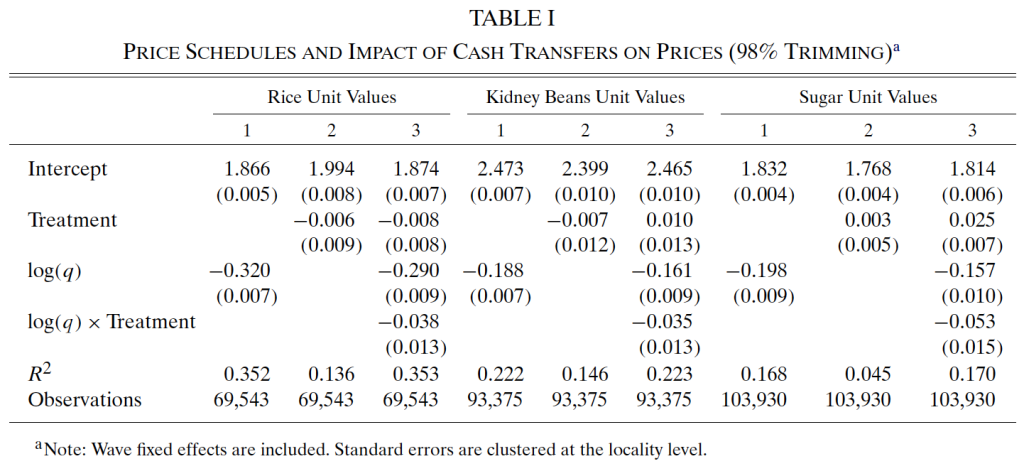

We detect this form of price discrimination in rural Mexico, where we study 363 local markets for rice, 408 for kidney beans, and 451 for sugar; see columns 1 of Table 1 from the paper, reported here, which show that unit prices significantly depend on the quantities purchased. Specifically, we find that the local unit prices (prices per kilogram) of these food items are much higher for small quantities than for large ones. In the average village we study, for instance, it costs about 1 peso to buy 0.1 kilos of rice but only 3 pesos to buy 2 kilos of rice. Hence, the price per kilo or unit price of 0.1 kilos of rice is 10 pesos whereas the unit price of 2 kilos of rice is only 1.5 pesos. As columns 1 of Table 1 show, we estimate that the elasticity of unit prices with respect to quantity is largest in absolute value for rice, 0.320, but it is also sizable for the other two goods: 0.188 for kidney beans and 0.198 for sugar. For each good, this elasticity is statistically different from zero.

The effects of this form of price discrimination on the consumption of poor households are subtle, and the presence of price discrimination can lead income transfers to have price effects that adversely affect poor households. We examine each of these two points in turn in the following two sections.

Price Discrimination and Market Participation

The reason why sellers often discriminate across consumers by charging higher unit prices for smaller quantities of a good than for larger ones, that is, through quantity discounts, is simple. When consumers differ in their intensity of preference for a good, a seller has an incentive to sell smaller quantities of a good at higher unit prices to induce consumers who like the good relatively more to purchase more of it. This is the logic of, say, “three for the price of two” promotions, which are meant to encourage consumers to buy three units of a good instead of only one or two. In the example above, buying 2 kilos of rice is indeed much cheaper per kilo than buying 0.1 kilos of rice.

Cash transfers in Mexico have had perverse price effects due to the presence of seller market power.

The evidence that poor households pay higher unit prices than rich households for the same goods and services they purchase is usually interpreted to imply that nonlinear pricing leads to undesirably low levels of consumption among the poor. In our work, we argue that the implications of quantity discounts are, in general, less obvious. Quantity discounts, although distortionary, may help the poor. In fact, the imposition—say, by regulation—of a constant unit price might even end up excluding some households, especially the poor ones, from the market.

To see how quantity discounts can stimulate market participation relative to linear pricing, note that to attract poor consumers, sellers who price their goods linearly may have to lower their prices for all consumers so much that their overall profits would substantially decrease. Thus, it may not be in a seller’s best interest to serve the poorest consumers, who are then priced out of the market. Under nonlinear pricing, by contrast, a seller can lower the price of small quantities without lowering the price of large quantities—that is, a seller can make a profit by serving poor consumers as well. We find ample evidence of this type of incentives in the markets for common staples that we study in rural Mexico.

Furthermore, it is well known that in developing countries, many consumers spend a large fraction of their incomes on food, face subsistence constraints on consumption, and have access to several alternative consumption possibilities—including self-production and highly subsidized government stores—whose attractiveness and feasibility differ among consumers. Hence, consumers can differ significantly both in their marginal willingness to pay for a good and in their absolute ability to do so. Our theory of price discrimination, which explicitly accounts for these features, implies that price discrimination through quantity discounts in these instances need not disproportionately depress the consumption of poor households. In fact, this form of price discrimination may significantly increase both consumption and market participation among the poor, relative to linear pricing.

We find evidence of these patterns for our sample of villages in rural Mexico. For each market, we estimate households’ preferences for the consumption of these goods and sellers’ cost structure. Based on these estimates, we conclude that a substantial fraction of consumers, that is, up to 30 percent of households in the first three quartiles of the distribution of quantities purchased in a village, that is, the lowest 75 percent, consume much more than they would have under linear pricing. Depending on the good considered, we estimate that between 20 percent and 70 percent of households who purchase the smallest quantities—the poorest among poor consumers—would be excluded from the market under linear pricing.

Naturally, in the presence of sizable quantity discounts, especially for storable goods, consumers have an incentive to pool resources and collectively buy larger quantities. These arrangements, however, are rarely observed in practice, including in developing countries. In the sample of isolated rural communities we study, in which individual households live at a considerable distance from shops and from each other, these arrangements are likely to be difficult to sustain because of substantial transportation costs, coordination issues, and asymmetric information among households. It might therefore be very difficult for households to pool enough resources for these group purchases, or to agree on, and enforce, their division. Perhaps as a result, these sorts of arrangements are not observed in the communities that we study and the purchase of small quantities at high unit prices is frequent. Indeed, we document quantity discounts in all the local markets for rice, kidney beans, and sugar that we examine.

Cash transfers have had substantial price effects that likely disproportionately hurt poor households.

The Price Effects of Cash Transfers

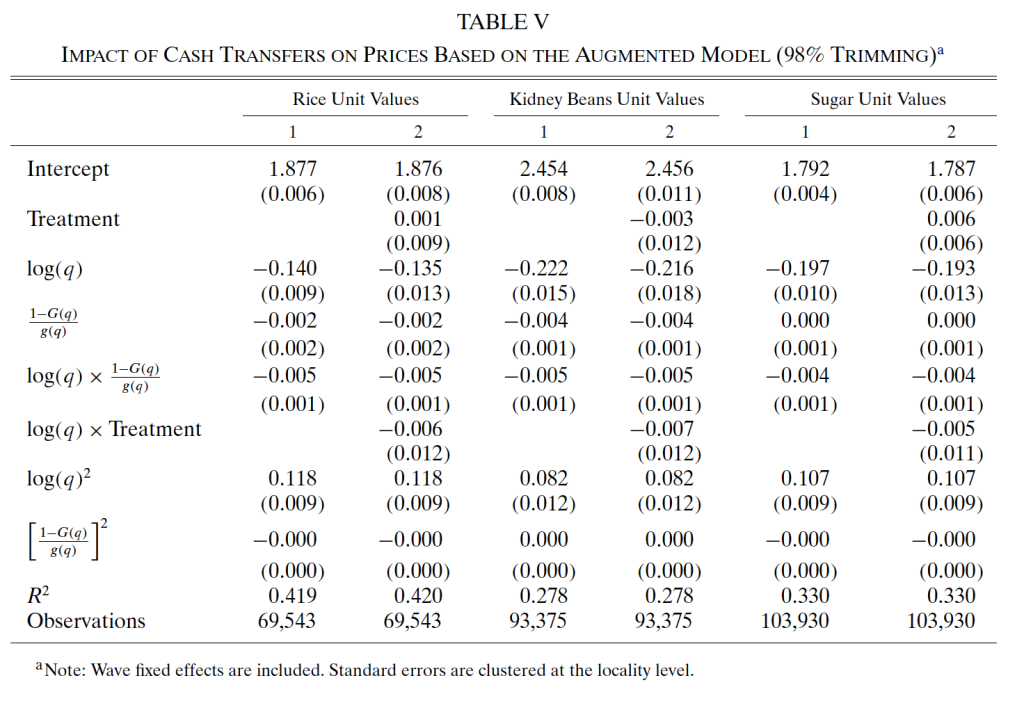

It turns out that cash transfers may have perverse effects in the presence of quantity discounts. The intuition is as follows. Sellers who price their goods and services nonlinearly have an incentive to charge higher unit prices to consumers whose ability to pay increases relatively more because of the transfers they receive. Poorer households, who purchase smaller quantities and tend to receive larger transfers, may then end up paying higher unit prices after transfers are introduced. By contrast, richer households, who purchase larger quantities and tend to receive smaller transfers, may end up paying even lower unit prices after transfers are introduced, as larger quantities may now be offered at greater discounts. Why? Naturally, as subsistence constraints become less important, households’ budgets increase, and the degree of price discrimination correspondingly intensifies. Hence, cash transfers may be much less progressive than commonly thought. Existing work that has evaluated cash transfers has ignored the dispersion in the unit prices of different quantities purchased, which explains why the full extent of the impact of cash transfers on prices has not yet been documented. In particular, the evidence that average unit prices are unaffected by cash transfers may mask important changes in the unit prices of different quantities. In our research, we show that the Progresa cash transfers, which are more generous for poorer households, have significantly tilted the price schedules of the basic commodities we consider and increased the degree of price discrimination, by leading to increases in the unit prices of small quantities, purchased by poorer households, and, at the same time, to decreases in the unit prices of large quantities, purchased by richer households. See columns 2 and 3 of Table 1, which show that the treatment indicator for Progresa significantly affects the slopes of the price schedules of the three goods. The model of pricing we propose successfully explains this observed shift in price schedules. Columns 2 of Table V from the paper, reported here, indeed show that once we fully account for the nonlinearity of unit prices through their dependence on the quantities purchased, log(q), and on the inverse hazard rate of the distribution of quantities purchased in a village, [1-G(q)]/g(q)], as implied by our model, the treatment indicator for Progresa has no longer much of an effect on either the intercepts or the slopes of the price schedules of the three goods.

Overall, we find that although Progresa has increased consumption without much of an impact on average unit prices in the villages in our sample, the program has resulted in an increase in the magnitude of quantity discounts. Across the goods we study, it has led poorer households to face 13 to 30 percent higher unit prices and richer households to face 6 to 12 percent lower unit prices than before the program. For instance, the unit prices of the quantities in the bottom 25 percent of the distribution of quantities purchased across treated villages (that is, those villages receiving transfers) are, on average, 13.2 percent higher for rice, 24.3 percent higher for kidney beans, and 29.8 percent higher for sugar than across control villages (that is, those villages not receiving transfers). On the contrary, the unit prices of the quantities in the top 25 percent of the distribution of quantities purchased across treated villages are, on average, 12.3 percent lower for rice, 12.1 percent lower for kidney beans, and 5.6 percent lower for sugar than across control villages.

These shifts in price schedules might have dampened the beneficial effects of the program, which was targeted at the poorest segments of the population. Price effects are unlikely to have muted the overall positive impact of Progresa on many households, however, as the cash transfer represented as much as 25 percent of the income of many beneficiaries. Measuring the net overall welfare effect of the program is not a simple exercise, though. In addition to accounting for the price effects we have documented, this type of calculation would need to consider a variety of other factors, including the possibility of transfers among households. Such an exercise would also need to incorporate the effective change in the relative price (and therefore, for some households, in the level of consumption) of other goods and services—such as education—that were part of the conditionality of the cash transfers.

Poor households may access markets at more favorable terms under price discrimination than they would under linear pricing.

Intuitively, as we consider data from 1998, when the program was first introduced, to 2003, the impacts we document are of a short-run nature. It is possible that, in the long run, the introduction of transfers will lead to the entry of additional sellers and so to an increase in degree of market competition, which would be beneficial to consumers—particularly to poor consumers. Examining the evolution of the structure of these markets in response to Progresa is an important yet challenging question that we have left for future research. For instance, it would not be possible to exploit the random exposure of different villages to the program for this purpose, as Progresa was eventually expanded nationally. Nonetheless, our analysis points to an important role for firms’ market power in mediating the effects of large-scale income support programs on households.

Policy Implications

The roles of differences in consumers’ preferences and consumption opportunities, and of sellers’ market power, are often overlooked when evaluating large-scale policies such as cash transfers. Our theoretical and empirical work provides a first step towards performing much-needed further analysis of how market power on the part of sellers affects the distributional impact of income transfers and similar poverty alleviation programs.

To conclude, we draw three important lessons. First, accounting for differences among consumers (in their preferences, incomes, and consumption possibilities) and for seller market power helps shed light on how price discrimination can be less detrimental for consumers than often thought. Second, the appeal of identical unit prices for all consumers, as a proxy for the equality of opportunity for market access and consumption, may be overstated if not altogether misleading in settings in which sellers price discriminate across consumers. Third, income transfers can have adverse price effects for the most vulnerable segments of consumers when markets are imperfectly competitive, which can reduce their intended benefits.

Both the demand and the supply side of a market must be considered when designing and evaluating large-scale income support programs.

Understanding market structure and the price mechanism is necessary before finessing the details of any policy. Reducing seller market power and stimulating greater competition—by, for instance, lowering production and distribution costs through more granular and more reliable infrastructure and transportation systems—may be even as important as cash transfer programs themselves in alleviating poverty.

This article summarizes ‘‘Nonlinear Pricing in Village Economies’’ by Orazio Attanasio and Elena Pastorino, published in Econometrica in 2020.

Orazio Attanasio is at Yale University, the Institute for Fiscal Studies, University College London, CEPR, FAIR at NHH, and NBER. Elena Pastorino is at Stanford University, the Hoover Institution, and NBER.