Our study explores the importance of these two factors – technological innovation and regulatory arbitrage – in the New York City taxi market. Our study is part of an emerging body of research in economics that explores the implications of technological change in the transport sector. Another notable study that complements ours is by Nick […]

Who benefits from rent control? Evidence from San Francisco

In 2019, Oregon and California became the first states to pass statewide rent control. Lawmakers in other states, including Colorado and Illinois, are considering repealing laws that limit cities’ abilities to pass or expand rent control. Rent control is already extremely popular around the San Francisco Bay Area: nine cities already impose rent control regulations, […]

Effects of vertical mergers in multichannel TV markets: evidence from regional sports programming

So-called ‘vertical’ mergers between producers of TV channels and distributors of those channels are regular – and sometimes highly contested – events, both in the United States and elsewhere in the world. The attention that such mergers have attracted is partly due to the industry’s overwhelming reach and size: over 80% of the approximately 120 […]

When Fewer Options are Better for Consumers: The Benefits of Narrow Health Insurance Networks

The desirability and effectiveness of health network regulation depends on the reasons insurers might engage in exclusion in the first place, and whether the gains they realize are shared with consumers. In our research, we identify three main reasons why an insurer might wish to exclude a medical provider from its network, and we highlight […]

Providing low-cost labor market information to assist jobseekers

Do jobseekers benefit from tailored advice about suitable occupations provided by employment agencies? This column reports the results of a randomized field experiment in which a group of unemployed people received suggestions for alternative occupations based on labor market statistics. The researchers find that the information stimulates the recipients to broaden their search to a more diverse set of occupations. What’s more, they receive a significantly larger number of invitations to job interviews, which is concentrated among those with longer unemployment. These findings suggest that jobseekers find it difficult to access relevant labor market information themselves, and that they can be offered valuable tailored advice in a low-cost, automated way.

Subsidizing health insurance for low-income adults: evidence from Massachusetts

How much are low-income people willing to pay for health insurance – and what are the implications for our understanding of health insurance markets and the role of subsidies? This research investigates these questions drawing on subsidy variation in Massachusetts’ health insurance exchange for low-income individuals.

Understanding the Average Impact of Microcredit

The global microloan portfolio is now worth over 102 billion dollars and is growing yearly. This research estimates the impact of the policy and the extent to which this impact is different across different contexts. It finds that overall, the best existing evidence suggests that the average impact of these loans is small and that in the future, it may be beneficial to seek alternative approaches to improve the lives of poor households in the developing world.

Nominal wage rigidity in village labor markets: evidence from India

Markets for daily wage labor are ubiquitous in poor countries, providing employment for hundreds of millions of workers in India alone. In an exploration of how nominal wages in these markets respond to changing economic conditions, this research finds strong evidence of limited downward adjustment in the face of a negative shock. A key part of the explanation lies in perceptions that wage cuts are unfair and reduce worker productivity. The higher unemployment that results from nominal wage rigidity could be addressed by counter-cyclical employment programs, and by modest levels of inflation that allow real wages to adjust in a way that avoids too much harm to workers.

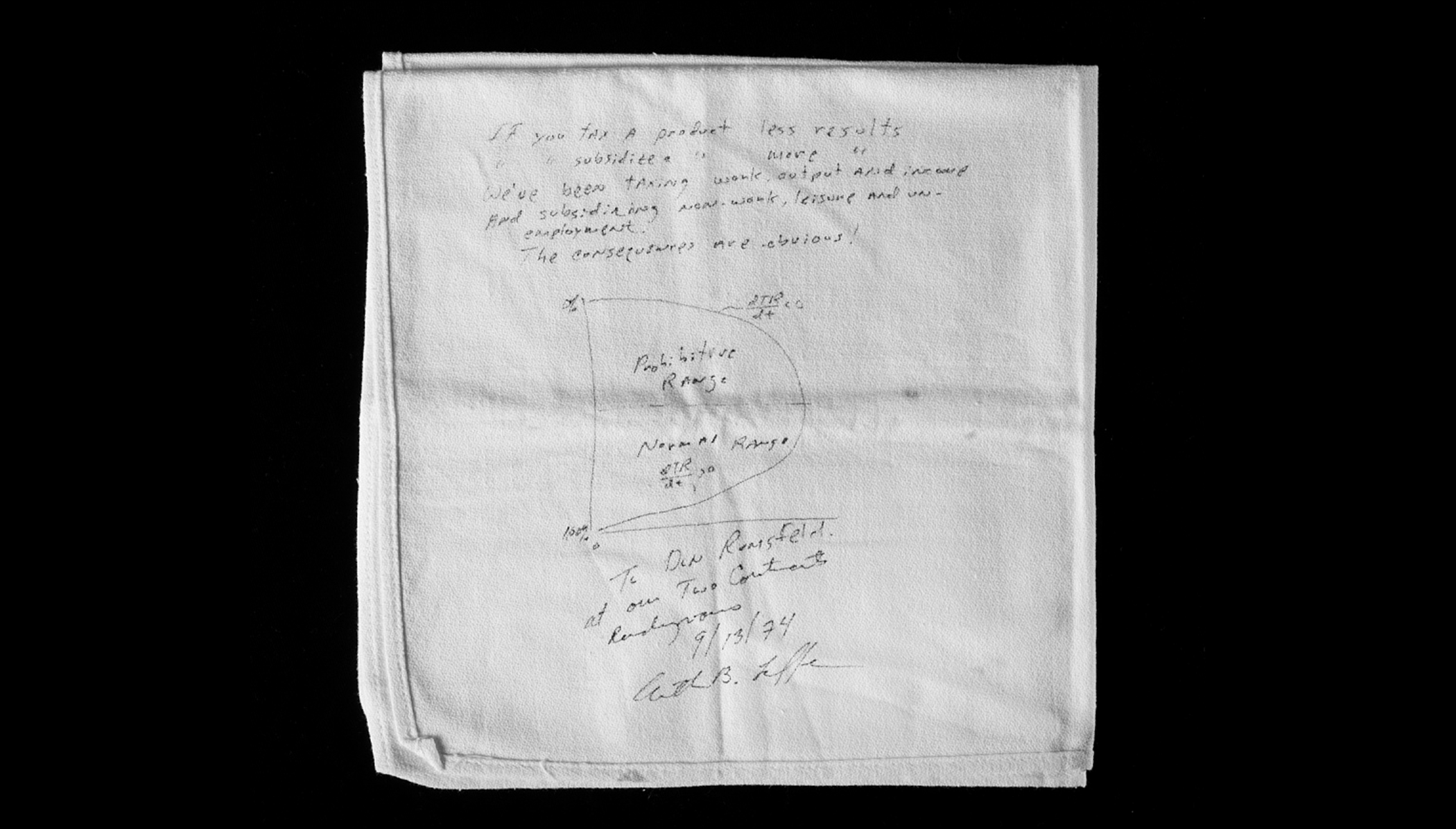

Market power and the Laffer curve

Arthur Laffer, who was recently awarded the Presidential Medal of Freedom, is famous for sketching an inverted U-shaped diagram of the supposed trade-off between tax rates and tax revenues. The Laffer curve helps to characterize how firms as well as consumers respond to tax changes, and this research uses it to evaluate whether commodity taxes are an effective tool for financing government expenditure. Applying the idea to taxation of distilled spirits in Pennsylvania, where retail sales only take place through a state-run monopoly, the study shows how firms with market power change their pricing when taxes are cut and what that implies for state tax revenues.

How management practices drive firms’ performance in the long run: evidence from the Marshall Plan

Economists have long speculated about why there are large differences in productivity across both firms and countries. One explanation is that they reflect variation in management practices, which raises the question of whether management training can improve firms’ performance. This research examines the long-run effects of such training, using evidence from the US Productivity Program […]