Summary

Whether by sea, land or air, the entirety of trade is carried out by the transportation sector. We know surprisingly little, however, about the role of transportation in shaping trade networks. How do transport markets interact with the markets for world trade in goods? How does the behavior of profit-maximizing transport agents influence transport costs, and thus global imports and exports?

A new paper uses vessel AIS data—which regularly reports each ship’s exact position and how deeply it is submerged in the water—and data on shipping contracts to document several facts about transport markets and world trade. The paper illustrates that ships travel empty almost half the time, partly as a result of large trade imbalances. It demonstrates that the net export position of both origin and destination countries are an important determinant of the transport costs that exporters pay. Finally, it shows that transport costs have a substantial impact on world trade, estimating that a 1% change in shipping costs leads to around a 1% change in world trade value.

The authors go on to build a quantitative framework to study the role of transport markets in world trade, with the goal of understanding how the optimal behavior of transportation agents affects observed trade flows.

Through simulating the effects of an oil shock, a Chinese slow-down, and the opening of the Northwest Passage, the authors demonstrate three mechanisms through which transportation affects global grade. First, transport markets attenuate differences in the comparative advantage across countries, reallocating production from net exporters to net importers. Second, they create network effects in trade costs. Finally, transport markets dampen the impact of shocks on trade flows. Taken together, these mechanisms reveal a new role for geography in international trade.

Main article

A recent study uses detailed AIS data on ship movements to shed light on the surprisingly little-studied question of how transport markets affect world trade. Trade costs and flows are shown to be largely shaped by the behavior of profit-maximizing transport agents. Transportation is shown to create network effects, dampen shocks and lead to complementarities between a country’s imports and exports. As such, the paper reveals a new role for geography in international trade.

Whether by sea, land, or air, trade functions through the transportation sector. Transportation is therefore central to everyday life. Surprisingly little is known, however, about how the market for transportation services interacts with the global market for goods. Recently, the delays in trade costing billions caused by both the blockage of the Suez Canal by the mega-ship “Ever Given”, as well as the shortages in transport supply generated in the later phase of the COVID pandemic, reminded the world of the vital role of this, sometimes “invisible” sector. In a recent paper, we use big data from the dry bulk shipping industry to study how this interaction shapes trade flows, trade costs, the propagation of shocks, and the allocation of productive activities across countries.In a recent paper, we use big data from the dry bulk shipping industry to study how this interaction shapes trade flows, trade costs, the propagation of shocks, and the allocation of productive activities across countries.

The transportation sector includes several different segments, which can be split into two categories. First, there are those that operate on fixed itineraries, much like buses. Containerships, airplanes, and trains primarily belong to this group. Second, there are those that operate on flexible routes, much like taxis. Most trucks, gas/oil tankers, and dry bulk ships belong in this second group.

Our work focuses on oceanic shipping, using dry bulk shipping as a focal case study. Ships carry about 80% of world trade volume, of which about half uses dry bulk ships. In particular, these , these dry bulk ships are the main mode of transportation for commodities, such as grain, ore, and coal. They are often termed the “ocean taxis”— exporters search available vessels and hire them for specific voyages, with prices set in the spot market in a decentralized fashion.

Big ship data and stylized facts

Our analysis is based on a unique dataset of ship movements. We employ AIS (Automatic Identification System) information on about 5,000 ships, corresponding to half of the world fleet. We observe every ship’s exact position every 6 minutes, as well as its draft—how deeply submerged the vessel is in the water—which reveals whether it is traveling loaded or empty. The dataset thus contains a ship’s history of trips, as well as its behavior while searching for cargo. Finally, we also obtain a dataset of shipping contracts, providing information on shipping prices. Analysis of these datasets reveals three stylized facts.

Fact 1: There is a significant imbalance in the world trade in commodities

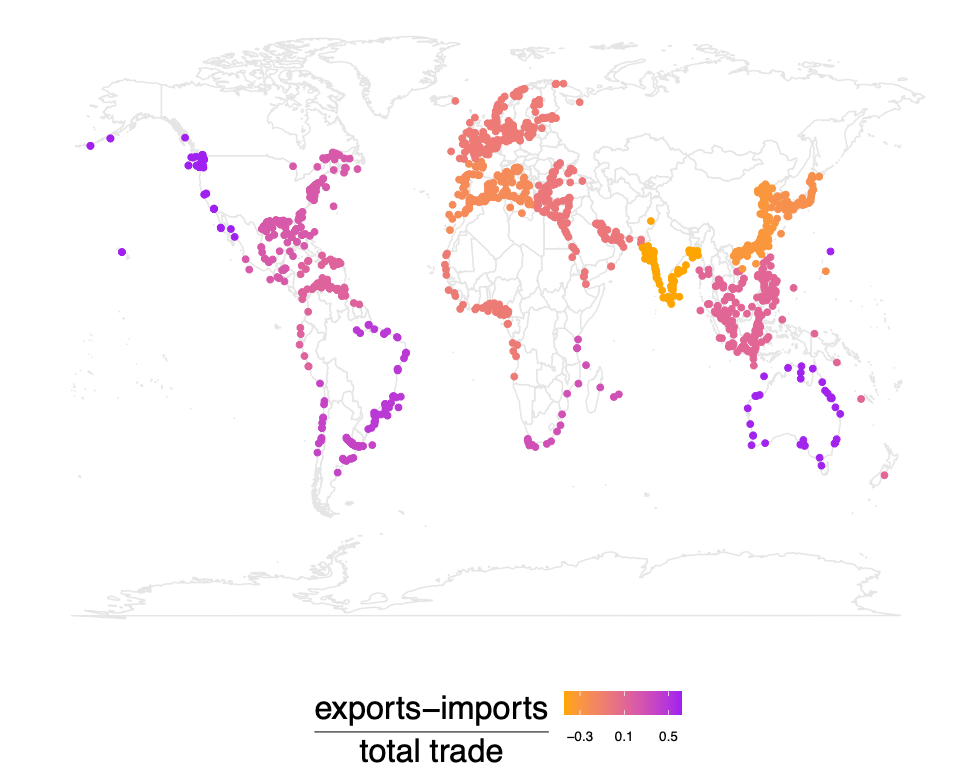

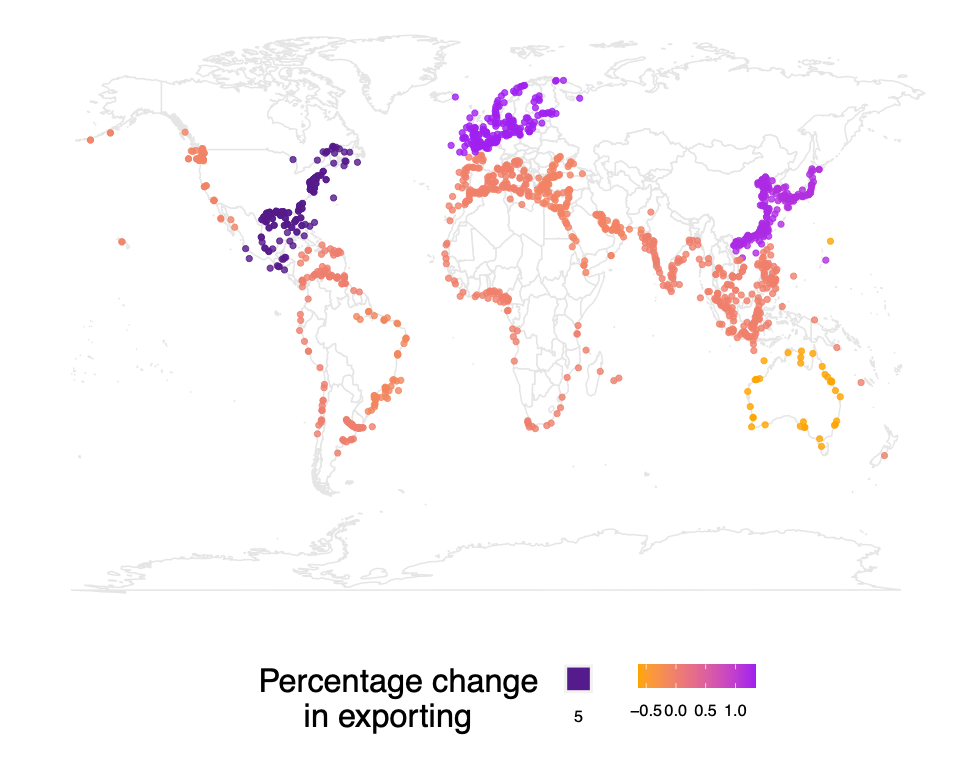

Ship movements reveal that most countries are either large net importers or large net exporters(Figure 1). The fact that global trade features such large imbalances is not surprising; it is due, to a large extent, to countries’ differing natural inheritance. For instance, Australia, Brazil, and Northwest America –the world’s biggest net exporters—are rich in resources such as minerals, grain, and coal. At the same time, growing developing countries require imports of raw materials to achieve industrial expansion and build infrastructure. Recent Chinese growth has relied on massive imports of raw materials, for example. As a result, commodities flow out of producers, such as Australia and Brazil, and towards China and India, which are the world’s biggest net importers.

Figure 1: Difference between exports (ships leaving loaded) and imports (ships arriving loaded) over total trade (all ships). A positive (negative) ratio indicates that a country is a net exporter (importer); a ratio close to zero implies balanced trade.

As a consequence of the imbalanced nature of international trade, ships spend much of their time traveling without cargo (termed “ballast”). Atany point in time, a staggering 42% of ships are travelling ballast.

Fact 2: Net export position is an important determinant of trade costs

This trade imbalance is a key driver of the trade costs that exporters face, which are geographically asymmetric. Ships demand a premium to travel towards a destination with low exports, to compensate for the difficulty of finding a new cargo originating from that destination. Other things being equal, the higher the prospect of having to travel ballast after offloading, the higher the price of the trip. For example, a trip from China to Australia costs on average 7,500 dollars per day, while a trip from Australia to China costs on average 10,000 dollars per day. As China mostly imports raw materials, ships arriving there have limited opportunities to find cargo for the return trip.

This phenomenon is pervasive in most, if not all, modes of transportation: trucks, trains, and container air and ocean shipping all exhibit similar price asymmetries that correlate with trade imbalances (though the direction of the imbalance may be reversed). We see this in action in the United States, where US-China trade deficit in manufacturing has incentivized US exports of low-value cargo, such as scrap or hay, to fill up empty backhauls.

Fact 3: Transport costs have a substantial impact on world trade.

We exploit changes in tariffs across the trade network, which alter the perceived attractiveness of different destinations from the transportation agent’s perspective, to estimate the elasticity of world trade volume with respect to shipping costs. We find that a 1% change in shipping costs leads to about a 1% change in world trade value.

A spatial trade model

Inspired by these facts, we built a quantitative framework to study the role of transport markets in world trade, with the goal of understanding how the optimal behavior of transportation agents affects observed trade flows.

Our spatial trade model splits the globe into a number of regions that trade with each other. Geography enters the model both through regions’ location in space, and their natural inheritance in commodities of different value. In each region and in each time period, available ships and exporters search for each other. Ships that meet an exporter will carry the exporter’s cargo to their export destination and restart searching there. The shipping price is negotiated between the two parties. Ships that fail to meet an exporter decide whether to wait at their current location or ballast elsewhere. When doing so, they incur travel costs, such as fuel. Exporters that do not meet a ship must wait at port. Finally, a large number of potential exporters decide whether and where to export, thus replenishing the exporter pool seeking transportation in every time period.

The outcomes of our simulation are bilateral trade volumes and the shipping prices (trade costs) paid by exporters. As ships care about the future trips they will have to make, trade costs depend on the attractiveness of both the origin and the destination. This attractiveness in turn depends on the regions’ location, export values, and matching probabilities, as well as their neighbors’ attractiveness. For instance, ships require higher prices to take iron ore from Australia to China than they do for the reverse journey: loading probabilities are high in Australia, while in China ships are likely to wait before finding cargo, or may have to ballast elsewhere in search of loading opportunities.

This insight applies beyond dry bulk. Although other transport modes require different modeling assumptions regarding their operational practices, in equilibrium, prices are formed by the optimizing behavior of forward-looking transport agents. These prices therefore unavoidably depend, as above, on the attractiveness of origin and destination countries, as well as that of their neighbors.

Three experiments to illustrate the role of transport markets

Why is it important to account for the transport sector when studying international trade in goods? We illustrate the role of transportation through three experiments.

Experiment 1: Oil Shocks

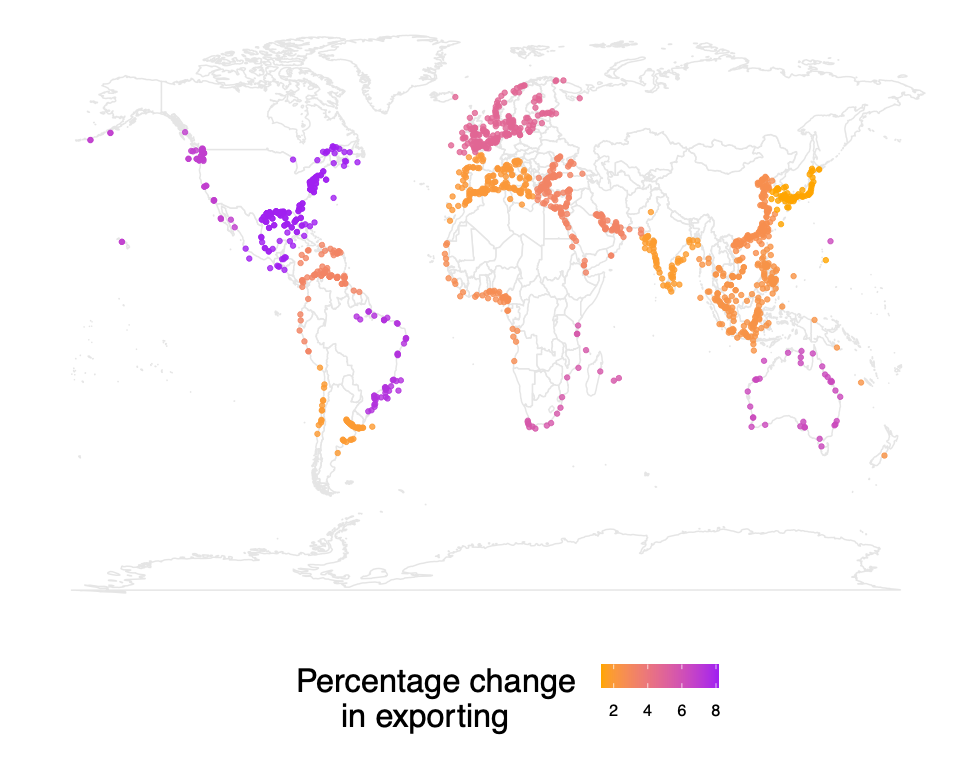

A decline in fuel costs represents a decline in a ship’s operation costs, and therefore instantly translates to a decline in shipping prices, followed by—other things being equal—a rise in exports.

The oil shock also has an additional, perhaps less straightforward, negative impact on the economies of net raw materials importers, such as China and India. Reduced sailing costs imply that ships are less “tied” to their current region, which means that their bargaining position is stronger and they can negotiate higher prices. This is more severe in net importing regions: ships ending a trip there are now less likely to wait as it is cheaper to ballast. They thus command even higher prices to stay there, which further reduces exports from these regions and increases exports from the regions where ships ballast to, which will tend to be the existing net exporters.

Asfuel costs decline, therefore, distance matters less and the world gets “flatter”; the importance of the transport sector is reduced, and trade is driven to a greater extent by comparative advantages. As a result, big exporters benefit disproportionally from declines in fuel costs, widening trade gaps.

Figure 2: Impact of a 10% decline in fuels cost.

Experiment 2: Chinese slow-down

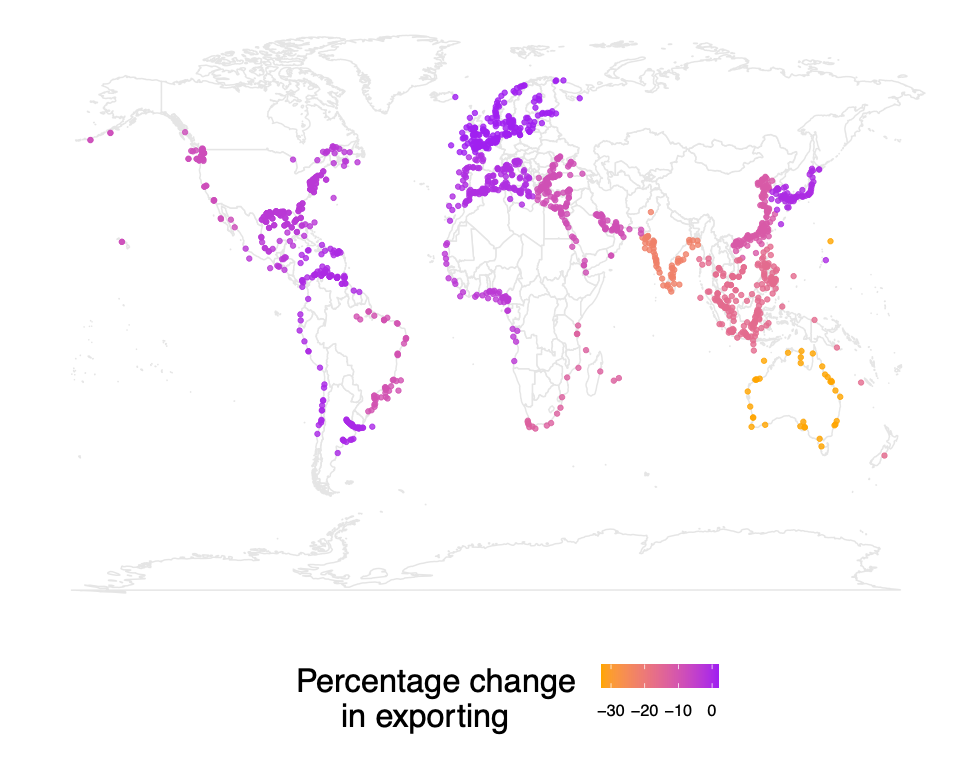

Here we explore the spatial propagation of a macro shock, in this case a slow-down in China, captured by a decline in Chinese imports (Figure 3).

First, we look at China itself. Although the country is primarily an importer when it comes to commodities and raw materials, we find that a decline in Chinese imports leads to—perhaps surprisingly—a decline in Chinese exports, even though they are not directly affected by the shock.

The mechanism in place here is that transport markets create a complementarity between imports and exports; high Chinese imports leads to a large number of ships ending their trip in China and looking for freight there, which in turn reduces trade costs for Chinese exporters. Conversely, when imports decline, fewer ships end up in China and Chinese exporters are hurt.

Second, the decrease in Chinese imports obviously implies a decrease in exports for China’s trading partners, such as Australia, Indonesia and Brazil. In addition to this “direct” effect, transport markets will experience secondary effects, which will vary by country depending on distance from China. Distant countries, such as Brazil, experience a decline in exports, but they benefit from the reallocation of ships across space. In particular, prior to the shock, a large fraction of the fleet was located in the Southeast Pacific region, with ships traveling between China and its neighbors. Following the shock, these ships reallocate to other parts of the world, which—other things being equal—increases exports in those regions, dampening the overall decline from the direct effect.

This double effect underscores the importance of being close to large, growing net importers (as China has been over recent decades): exporting countries in that “pocket” of the world gained not only directly, by exporting to the importer, but also indirectly, from the increased supply of ships in their region.

Similar effects would be evident for a country that decides to move towards trade liberalization (or conversely protectionism), especially if its natural inheritance implies that it is a net importer like China. If a country is a net exporter instead and moves to liberalize its trade policies, we expect its imports to increase as well, as they benefit from reduced freight costs. A shift towards protectionism would have the opposite effects.

Figure 3: Impact of a 10% decline of the revenue from exporting to China.

Experiment 3: The Role of Maritime Infrastructure

How much do large maritime infrastructure projects contribute to world trade? As an illustration of how our setup can be used for policy evaluation, we examine the opening of the Northwest Passage. This opening, which is coming about through the melting of the arctic ice, is potentially very significant for trade transportation; traversing this route significantly reduces the travel distance between Northeast America/Northern Europe and the Far East. We then examine the impact of three natural and man-made passages: the Panama Canal, the Suez Canal, and Gibraltar.

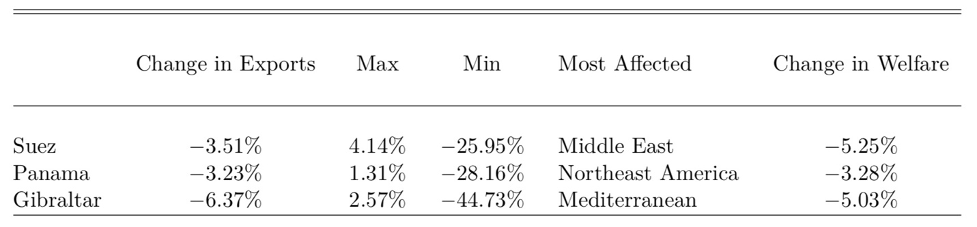

Not surprisingly, Northeast America and Northern Europe see their exports increase as a result of the opening of the Northwest Passage (Figure 4). Interestingly, exports from China and Japan/South Korea are only marginally affected. On one hand, the import-export complementarity pushes exports up. On the other hand, ships in China or Japan can now ballast to the East Coast of North America more cheaply. The ships’ better bargaining position tends to increase prices and decrease exporting in China and Japan.

Although the shock is local, it has global effects: as Northeast America becomes a more attractive ballasting choice, ships have a stronger bargaining position and demand higher prices in the rest of the world, pushing exports down. This illustrates how network effects lead to the propagation of local shocks.

Finally, inspired by the recent blockage of the Suez Canal by the Ever Given, a mega-ship of 200 DWT, we explore the impact of a permanent closure of three important passages (Suez, Panama, Gibraltar). To do so, we consider the change in world trade in their absence. These passages reduce nautical distances and thus the duration of specific trips. We find that all passages substantially increase world trade and welfare (see Table 1). Removing the Suez Canal reduces trade by 3.5% and up to 26% in the Middle East, while welfare falls by 5.25%. Removing the Panama Canal leads to a decline in world trade of 3%, but up to 28% in the Northeast America. Welfare falls by 3.3%. Finally, Gibraltar seems to be the most critical one, as removing it would reduce world trade by close to 7% and up to 44% in the Mediterranean with an overall welfare decline of 5%.

Figure 4: Change in exports under the opening of the Northwest passage.

Taken together, these experiments demonstrate the existence of three key transport-related mechanisms, which reveal a new role for geography in international trade. The transportation system:

- Attenuates differences in the comparative advantage across countries, reallocating production from net exporters, such as Australia and Brazil, to net importers, such as China and India;

- Creates network effects in trade costs that lead to the propagation of local trade shocks;

- Dampens the impact of shocks on trade flows.

This article summarizes ‘Geography, transportation, and endogenous trade costs’ by Giulia Brancaccio, Myrto Kalouptsidi, and Theodore Papapgeorgiou, published in Econometrica in March 2020.

Giulia Brancaccio is at Cornell University. Myrto Kalouptsidi is at Harvard University. Theodore Papapgeorgiou is at Boston College.