How widespread is tax evasion – and what does that imply for the true extent of inequality? This research explores these questions by analyzing a unique dataset of leaked customer lists from offshore financial institutions matched to administrative wealth records in Scandinavia. The results show that offshore tax evasion is highly concentrated among the rich. The top 0.01% of households by wealth evade about a quarter of the taxes they owe, largely by concealing assets and investment income abroad. Top wealth shares in Denmark, Norway and Sweden increase substantially when adding back these unreported assets, highlighting the need to take account of tax evasion to measure inequality accurately.

inequality

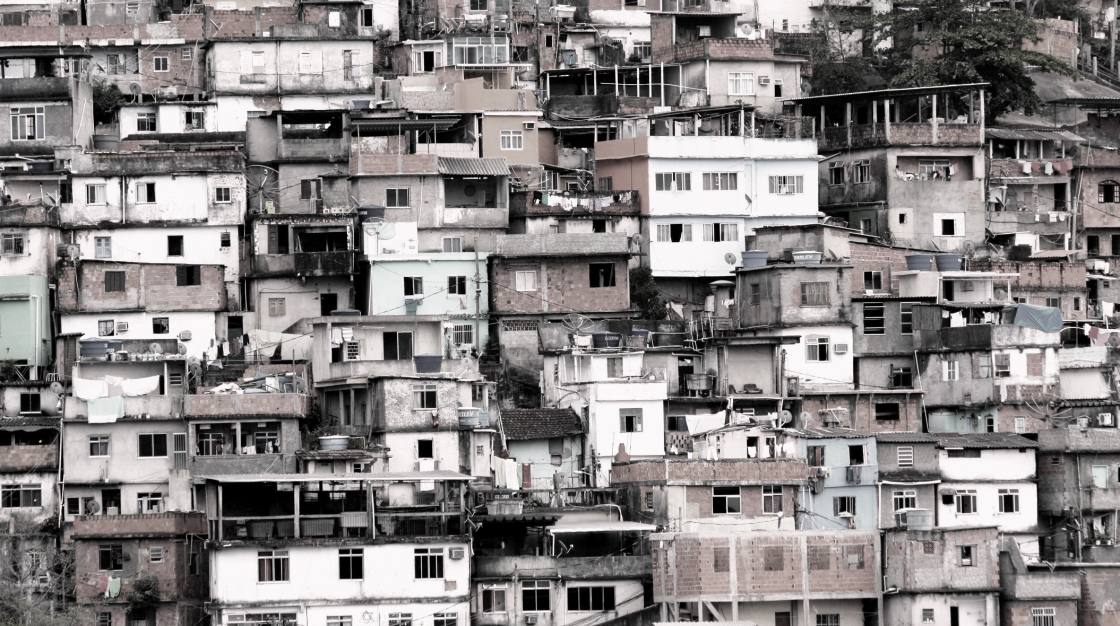

Absolute poverty: when necessity displaces desire

The number of people living in poverty in countries around the world is commonly measured using the World Bank’s poverty line – the ‘$1 per day’ that many people have heard of, though it has risen over time and now stands at $1.90 per day. However this measure assumes that the needs of the poor are the same in every country, an assumption at odds with the evidence and common sense. This paper develops a Basic Needs Poverty Line that overcomes this problem giving us new and in some cases surprising insight into the severity of the poverty problem in both rich and poor countries around the world.

Marital choices and widening economic inequality

While much attention has been paid to the education premium on the labor market, little study has been devoted to the marriage market. Looking back at four decades of US marriages, this research finds that more highly educated people are more likely to marry and that their spouses tend to be of similar academic achievement. Additionally, more educated couples invest greater time in developing their children’s potential. Meanwhile, children from less educated households enjoy fewer resources and are less likely to marry highly educated spouses, the upshot of which could be less social mobility and wider economic inequality.

The gender wage gap: how firms influence women’s pay relative to men

Employers’ pay policies can contribute to the gender wage gap if women are less likely to work at high-paying firms or if women negotiate worse wage bargains than men. Analysing data from Portugal’s labour market, this research finds that differences among firms can explain up to 20% of the gender wage gap. Women tend to be employed at less productive firms that offer lower wages to their employees. Moreover, when women are hired by better-paying firms, their wages rise less than men, possibly because they are less effective negotiators. These findings call for renewed attention to equal pay and fair hiring laws.