Summary

When confronted with new entry, incumbent firms often respond by introducing low-cost “fighting brands”. For example, the dominant microprocessor company Intel introduced its Celeron brand after being challenged by AMD. Incumbent airline companies Lufthansa and Air France launched Germanwings and HOP! respectively, in response to new low-cost carriers. This column reports recent research on the French mobile telecom industry, showing why the incumbent firms responded to the new entry of Free Mobile by simultaneously launching fighting brands, and how consumers benefited from greater choice. These findings imply that regulators and antitrust authorities should pay more attention to the effects of changing market structure on product variety, in addition to the effects on prices.

The effect of market structure on competition is an important question for regulators and antitrust authorities. The French mobile telecom industry is an especially interesting case. Until 2009, three incumbent firms had been unchallenged for more than a decade. The French regulator then granted a fourth entry license, to Free Mobile. When Free Mobile entered the market in 2012, the three incumbent firms responded almost simultaneously by launching “fighting brands” to take business from the new entrant and their other rivals. We study the incentives driving these launches and what they implied for prices and consumer choice.

The analysis starts from the theory of Johnson and Myatt (2003). They analyzed competition between firms when products can vary in quality, and showed that an incumbent monopoly firm may launch a fighting brand when a new firm enters a low-quality segment of the market, but not before. But there has been a lack of detailed evidence on the relevant incentives, and theoretical reasoning has often focused on a single incumbent rather than competition between several large firms.

We constructed a statistical model of the demand for different products in the French telecom market, and used this to study what happened when Free Mobile entered the market, including the patterns of substitution between brands. The results indicate that fighting brands can play a role even when there are several incumbent firms, perhaps because a new entrant disrupts incentives that previously worked towards tacit semi-collusion over product lines.

When a new firm enters, consumers may gain from lower prices and more choice, while incumbent firms and hence their owners lose out. The demand model can also be used to quantify these effects and the overall benefits. The entry of Free Mobile and then fighting brands meant gains for society as a whole, mainly driven by greater choice for consumers rather than lower prices. This finding has important implications for regulators and antitrust authorities, which should consider how changing market structure may influence product variety, and not just prices. Changing market structure can alter the product portfolio decisions made by firms, and the removal of artificial barriers to entry can mean substantial benefits for consumers.

Main article

The mobile telecom industry provides an interesting environment to study the impact of market structure on competition. Since the early 1990s, governments around the world have experimented with different approaches to allocate new spectrum licenses. In most countries, this has resulted in markets with at least three, but increasingly four or more, mobile network operators. The French market is an especially intriguing case. Until 2009, three incumbents, Orange, SFR and Bouygues Telecom, had been unchallenged for more than a decade. The French regulator then decided to promote competition by granting a fourth entry license to Free Mobile. When Free Mobile entered the market in 2012, the three incumbents responded almost simultaneously by launching the “fighting brands” Sosh, RED and B&You.

Understanding fighting brand strategies

Johnson and Myatt (2003) developed a model of competition where firms can offer products that vary in quality. They showed that an incumbent monopoly active in a high-quality segment may have an incentive to launch a product in a low-quality segment only after new entry in that segment, and not before. The intuition is that, in the absence of entry, launching a low-quality product merely cannibalizes the same firm’s existing sales of the high-quality product. After entry, however, there is a new “business stealing” incentive, since the firm can now take business from its rival. This can outweigh the cannibalization effect.

Later work by economists has provided further theoretical insights, and helps to understand the circumstances in which an incumbent may respond to new entry by launching fighting brands. But despite case study examples, detailed empirical evidence on the incentives to introduce fighting brands has been lacking. Furthermore, theoretical work has mainly focused on the case of a single monopoly incumbent. Hence, it remains unclear whether the fighting brand strategy can emerge under “oligopolistic” competition, between several large incumbent firms.

Our study of the French mobile telecom market with three oligopolistic incumbents has two objectives. First, we aim to understand the incentives at work in fighting brand strategies. Why did the three incumbent mobile network operators introduce their fighting brands only after a fourth firm entered, and not earlier as a way to compete with each other? Second, we aim to quantify the effects of entry, including the role of fighting brands, on the net benefits for consumers and society as a whole.

Data, market developments and methods

To understand the relevant incentives and effects, we construct a data set by combining various sources. First, we collect household panel data from the data analytics and consulting company Kantar, with information on the choice of mobile plan and plan characteristics at the quarterly level during 2011-2014. Second, we collect data on network quality from the radio spectrum agency ANFR, measured by the number of antennas per region and technology (2G, 3G, 4G).

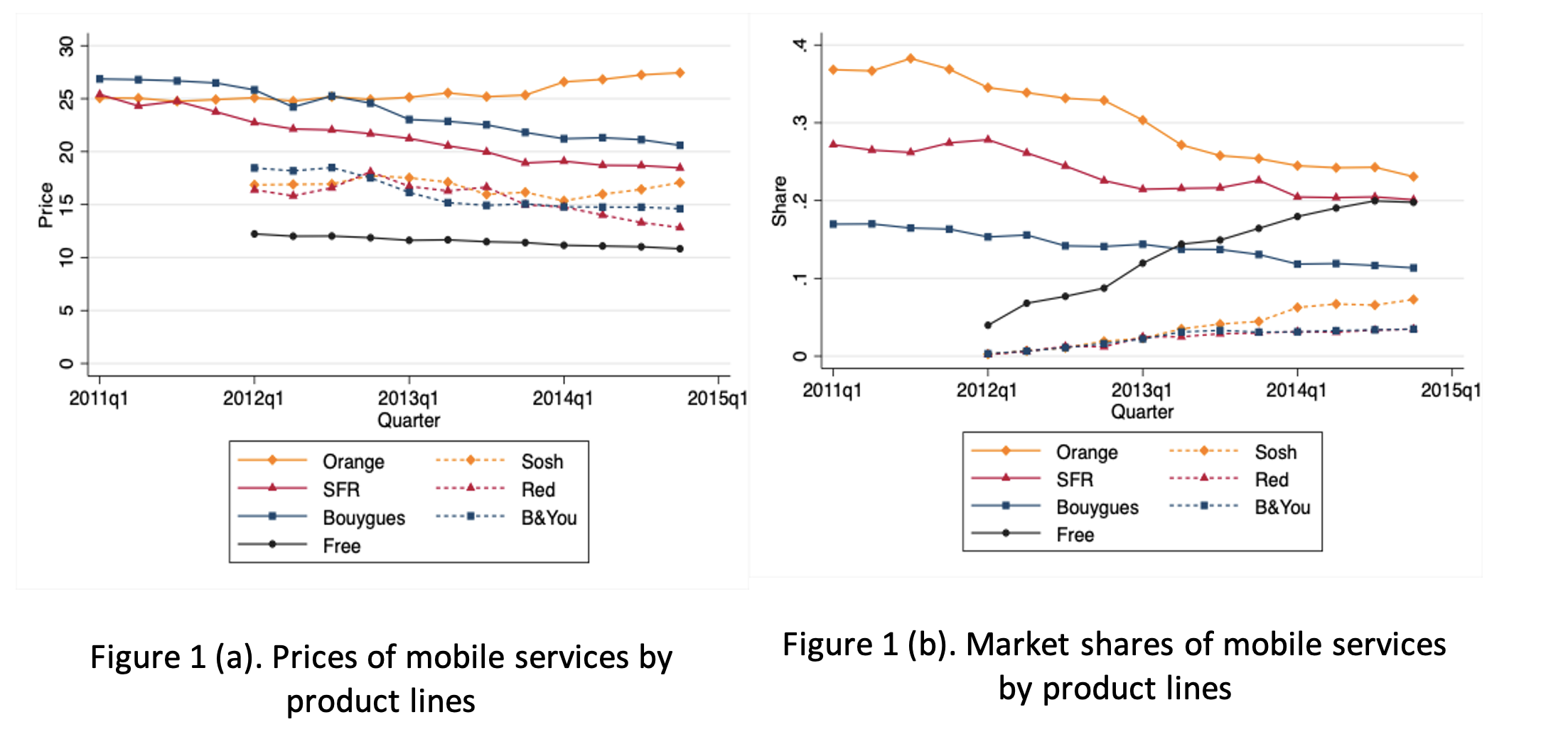

Figures 1(a) and 1(b) show the evolution of prices and market shares. They indicate the extent to which the new entry was disruptive. First, Free Mobile priced considerably below the incumbents’ premium brands. Second, the new fighting brands, such as Sosh from Orange, also charged lower prices, but not as low as Free Mobile. Third, Free Mobile gained a large market share, of about 20%, within a period of three years, while the fighting brands saw more modest growth.

Based on these data, we estimate a statistical model of consumer demand for the various products, given that the products are differentiated. The estimated own-price “elasticities” indicate how sensitive these demands are to prices. For the various brands here, the elasticities vary between -1.5 and -5.3, broadly in line with other work. Estimated “diversion ratios” can be used to show the following patterns of substitution between brands: (1) the three incumbent operators are the closest substitutes for each other, (2) the fighting brands draw most consumers from Free Mobile, and (3) Free Mobile mainly captures sales from the incumbent brands. These substitution patterns are crucial when evaluating the incentives to introduce fighting brands, and in particular the role of cannibalization and business stealing.

We assume that firms set prices non-cooperatively to maximize their profits. Using the demand estimates from the statistical model, the firms’ equilibrium markups fall in the range of 33%-40%. These are broadly in line with, though slightly higher than, the markups suggested by accounting information.

Counterfactual analysis: fighting brand incentives

We use the empirical oligopoly model to examine the fighting brand theory. We compute the counterfactual profits that would obtain under each of all eight possible market configurations: Free

Mobile enters or not, and each incumbent launches its fighting brand or not. This enables us to assess whether the incumbents had a strategic incentive to launch their subsidiary brands.

We find empirical results consistent with the fighting brand theory, but this requires extending the monopoly theory of Johnson and Myatt (2003) because here there are multiple incumbents. We can think of competition in the telecom market in terms of a strategic “game” between firms, and this game may be static or dynamic, depending on whether firms consider later time periods when making current decisions. Concretely, we find that:

- The incumbents’ fighting brand strategies in response to entry are hard to rationalize as optimal strategic choices in a simple static game. Intuitively, with multiple incumbent firms, there are already strong unilateral incentives to introduce fighting brands even without entry, because the gain from business stealing is greater than the loss from cannibalization. As such, a static model would predict the emergence of low-cost brands even without the entry of Free Mobile.

- The incumbents’ strategies can instead be rationalized as a breakdown of tacit semi-collusion in a dynamic game. In the absence of the fourth entrant, the incumbents could successfully collude, at least tacitly, to restrict their product lines to avoid cannibalization. The new entry of the low-end competitor made this outcome harder to sustain, because of increased business stealing incentives.

Importantly, an interpretation that there was tacit semi-collusion in restricting product lines need not imply the presence of illegal conduct, as our evidence relates only to incentives. Nevertheless, it is consistent with the earlier 2005 decision of the French competition authority on illegal agreements in the French mobile telecom market, relating to strategic information sharing and jointly-defined market share targets.

In principle, the simultaneous introduction of the incumbents’ subsidiary brands could instead be explained as a mere marketing innovation that coincided with the entry of Free Mobile. That said, it seems hard to reconcile the evidence with this view, because the low-cost product strategy was no longer a novelty and had been offered many years earlier in most other European countries.

Consumer and welfare effects

Market entry can often lead to lower prices and more choice. We quantify the impact of entry by Free Mobile on “consumer surplus”. Loosely speaking, this translates the benefits to consumers into an overall monetary equivalent. We also look at the consequences for society as a whole (“social welfare”). Given that the fighting brands are plausibly a direct response to entry, we include them in our calculations. More specifically, we decompose the impact of entry on consumers and total welfare into three distinct sources: (i) a variety effect that stems from the availability of the entrant’s new differentiated service; (ii) a price competition effect due to the incumbents’ price responses; and (iii) potentially a fighting brand effect, from the incumbents’ new subsidiary brands.

We find that the entry of Free Mobile increased consumer surplus by about €4.6 billion, or 7.7% of industry revenue, over the period 2012-2014. Consumers mainly benefited from the increased variety offered by Free Mobile and the fighting brands, responsible for 51% and 31% of the gains respectively. Consumers benefited to a lesser extent from the intensified price competition between existing operators: this accounted for only around 18% of the overall consumer gains.

To consider the net benefits for society as a whole, we have to consider not only the gains for consumers, but also the reduced profits for the incumbent firms and hence their owners. The entry of Free Mobile led to large losses in gross “producer surplus”. These partially offset the gains to consumers: the overall welfare gains were then estimated to be about €2.2 billion, or 3.7% of industry sales. These welfare gains can be attributed almost equally to the increase in variety due to Free Mobile and to the fighting brands. In contrast, increased price competition had a negligible effect on the welfare of society as a whole.

Policy implications

What do these findings imply for the regulation of entry and antitrust policy, and in particular for the assessment of horizontal mergers? First, it may be important to consider the impact of changing market structure on product variety, rather than focusing heavily on price effects. Second, we show how changing market structure can change the conduct of firms regarding product portfolio decisions. This consideration is similar to coordinated price effects, as found by Miller and Weinberg (2017) after the MillerCoors joint venture in the US beer market. Finally, we show that the removal of artificial barriers to entry can bring important benefits to consumers – even in markets where competing firms are under intense regulatory and antitrust scrutiny, such as the telecommunications market.

Our research also sheds light on some of the issues discussed in the assessment of the T-Mobile/Sprint merger in the US. This 4-to-3 merger involved the third-largest mobile operator, T-Mobile, and the fourth-largest, Sprint. It was filed in June 2018 and approved by the DOJ in July 2019; the transaction closed in April 2020 after a court appeal.

A concern raised by the DOJ and FCC staff during the investigation was that the merger could make it easier for the three remaining mobile network operators to coordinate and reduce competition, especially because it involved two industry mavericks, T-Mobile and Sprint (Asker and Katz, 2022). Competition between T-Mobile and Sprint had been particularly strong in the low-cost segment. Therefore, a major concern was whether the merger could change the incentives of a maverick firm like T-Mobile. T-Mobile responded that this would not be the case, and that they would even become a “super-maverick”, thanks to the efficiencies of the merger (Asker and Katz, 2022).

In our context, we have shown that when a fourth firm enters a three-player market, this can change firms’ incentives to compete aggressively for low-income consumers. Wallsten (2019) interrogated the merger between T-Mobile and Sprint, asking whether “a maverick firm remain[s] a maverick if it grows larger to compete with its two main rivals”. Our results for the French case suggest that a maverick firm may indeed not remain a maverick when it becomes larger through a merger.

This article summarizes “Market entry, fighting brands, and tacit collusion: Evidence from the French mobile telecommunications market” by Marc Bourreau, Yutec Sun, and Frank Verboven, published in the American Economic Review in 2021.

Marc Bourreau is at Telecom Paris, Yutec Sun is at CREST-ENSAI, and Frank Verboven is at KU Leuven.