Summary

Using an almost century-long dataset, we find that higher taxes negatively affect inventive activity and that inventors are geographically mobile in response to changes in tax incentives. As such, tax policy can exert a powerful effect on both the level and location of innovation. This has several important policy implications. It means, for example, that changes in the relative generosity of state-level tax incentives could shift the national distribution of innovation. It also means that general tax policy has to be set with an eye on its effects on innovation and that policy makers may need to consider providing other amenities to attract innovation.

How sensitive are inventors to changes in tax rates? This is a critical and controversial question in public policy given the centrality of the tax system to the structure of incentives in the real economy. If taxes influence net payoffs and the propensity to invent, taxes can potentially shape the production of ideas and therefore economic growth. As such, tax policy can exert a powerful effect on both the level and location of innovation.

A major obstacle to the study of tax changes on economic outcomes is lack of long-run data. To solve this problem, we assembled evidence over an entire century on state-level corporate and personal income tax rates, changes in federal tax rates, and US patents. Our research is grounded in a conceptual framework that allows both state-level (macro) and inventor-level (micro) estimates of the impact of taxes on innovation.

Our main finding at the macro level is that a one percent increase in the corporate net-of-tax rate leads to a 1.3 to 2.8 percent increase in innovation, whereas a one percent increase in the personal net-of-tax rate increases innovation by 0.8 to 1.8 percent. The elasticities are around half that magnitude at the micro level because the macro elasticity incorporates migration responses while the micro elasticity does not. Changes in state-level corporate taxes lead to roughly “zero-sum” outcomes at the macro-level as inventors move from one state to another, while changes in personal taxes induce both migratory and output responses.

Our evidence also shows that—controlling for factors such as a desire to stay in a home state— inventors were significantly less likely to locate in states with higher taxes, suggesting that taxes would have shaped long-run economic development at the state level.

Finally, our data suggests that the largest responses to tax changes occur around three to four years after a reform. Because the impact of taxes on innovation happens over time, our results suggest taxes can influence cumulative technological progress, which is a central feature of economic growth.

Our analysis contributes to several policy discussions. First, optimal income tax models should focus on the national and international mobility of inventors; our data indicates an approximately zero net mobility effect at the national level, but any international mobility of inventors in response to more generous tax incentives could shift the global distribution of innovation. Second, it has long been noted that the relationship between taxation and growth involves a tradeoff between marginal incentives and public goods provision. However, recent literature has estimated that the gains from industrial policies designed to encourage external economies of scale are small. Our research suggests that general tax policy may be a useful tool for determining where inventors choose to locate, which can then amplify the impact of technology clusters. Finally, our study shows how extensive data collection efforts over the long run can inform tax policy by exploiting the richness of the evolution of the tax system over both time and geography.

Main article

How sensitive are inventors to changes in tax rates? This is a critical and controversial question in public policy given the centrality of the tax system to the structure of incentives in the real economy. While targeted tax policies, such as R&D tax credits, can spur innovation, our work focuses on whether general personal and corporate income tax policy can also play a role.

Tax policy can exert a powerful effect on both the level and location of innovation

Consider famous inventors like the polymer researcher Stephanie Kwolek, who invented the technology for Kevlar fiber while working at Du Pont during the 1960s, or William Shockley the pioneer of transistors at Bell Labs in the 1940s, along with co-inventors John Bardeen and Walter Brattain. These individuals are often thought to have responded to intrinsic incentives for knowledge creation, rather than the net financial payoffs they expected to gain. But if taxes influence net payoffs and the propensity to invent, taxes can potentially shape the production of ideas and therefore economic growth. Our study shows that higher taxes negatively affect inventive activity and that inventors are geographically mobile in response to changes in tax incentives. As such, tax policy can exert a powerful effect on both the level and location of innovation.

The idea that tax policy is a relevant lever for determining innovation is growing in importance (Bloom, Van Reenen and Williams, 2019; Akcigit and Stantcheva, 2021; Jones, 2022). We know that within the OECD the most productive inventors tend to be highly geographically responsive to changes in in top tax rates (Akcigit, Baslandze and Stantcheva, 2016). Furthermore, taxes can affect numerous outcomes in the real economy, including employment growth (Zidar, 2019), where star scientists choose to locate (Moretti and Wilson, 2017), risk-taking in entrepreneurship (Cullen and Gordon, 2007), and resource allocation more generally (Auerbach, 2018). Yet, how taxes shape incentives for innovation over the long run is less well understood. The context for our study – the United States in the 20th century – is particularly informative since this was an era where innovative states grew much faster than less innovative states (Akcigit, Grigsby, and Nicholas, 2017). For much of the 20th century, the US led global economic growth through technological leadership (Gordon, 2016).

New Datasets on Taxes and Innovation

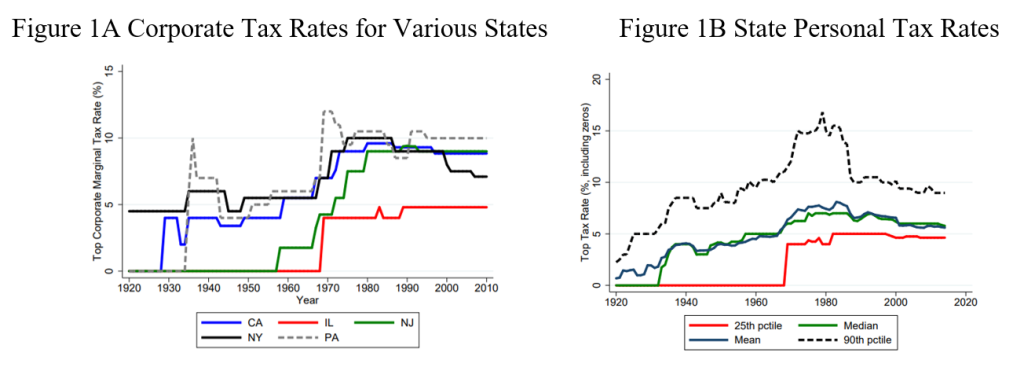

A major obstacle to the study of tax changes on economic outcomes is lack of long-run data. To solve this problem, we assembled evidence over an entire century on state-level corporate and personal income tax rates, and changes in federal tax rates. Our corporate database, stretching back to 1900, was painstakingly collected from archival sources and then linked to other components, including to personal tax rates from Bakija (2017) and to data on effective federal corporate tax rates from Auerbach and Poterba (1987) and from Auerbach (2007). Our data cover the long-run evolution of tax changes, including details of the early adopters of the corporate tax, such as the states of California and New York (see Figure 1A); the hike in state personal income taxes around the Second World War; and the lowering of state top personal tax rates since the 1980s (Figure 1B).

We also compiled data from millions of patents granted in the US since 1920. Notwithstanding that patents are an imperfect measure of innovation (Moser, 2016), we can track the productivity and location of inventors longitudinally with these data, such that we can identify the most salient responses to changes in marginal tax rates. Moreover, our data capture inventive activity at both the state level and inventor level over time. Due to this granularity, we can control for all sources of non-tax variation in innovation, such as agglomeration advantages that may attract inventors to a region independently of its tax code. We can further exploit multiple sharp tax reforms to provide causal estimates, and, given our long time series, we can also estimate dynamic responses.

Research Design and Main Findings

Our research is grounded in a conceptual framework that motivates state-level (macro) and inventor-level (micro) estimates of the impact of taxes on innovation. For example, we assume that responses to taxes depend on whether inventors work in corporations or outside the boundaries of firms as “garage inventors.” That enables both corporate and personal income net-of-tax rates to influence the production of innovations, since taxes will affect both the incentives of inventors to join firms and the net payoffs from these income flows. We also assume that inventors can choose which state to work in, so they can be mobile in response to tax regimes.

We use the conceptual framework to guide empirical estimates of responses of innovation to taxation. At the macro level, we estimate the effects of personal and corporate taxes on innovation outcomes (patents, citations, corporate versus non-corporate patents) at the state-year level. We then drill down to the micro level, where we can perform the same exercise while further exploiting variation in tax rates across inventors. To do this, we assign inventors to tax brackets based on their patenting productivity, under the assumption that productivity is correlated with income. This approach allows us to use a very granular empirical specification to measure tax responses for inventors in different tax brackets in the same state and year.

Our main finding at the macro level is that a one percent increase in the corporate net-of-tax rate (or equivalently the fraction of each marginal dollar of income retained by the taxpayer) leads to a 1.3 to 2.8 percent increase in innovation, whereas a one percent increase in the personal net-of-tax rate increases innovation by 0.8 to 1.8 percent. The elasticities are around half that magnitude at the micro level because the macro elasticity incorporates migration responses while the micro elasticity does not. Thus, the different macro- and micro-level elasticities can be explained by the fact that inventors move across states in response to tax changes, in line with our conceptual framework. Although changes in state-level corporate taxes lead to roughly “zero-sum” outcomes at the macro-level as inventors move from one state to another, changes in personal taxes induce both migratory and output responses.

We further investigate these mobility responses using a model of location choice. We can observe where inventors locate and where they may relocate. In our model, inventors face a set of “choice states” depending on the tax rates prevailing in a state. We also model preferences for location for other reasons such as the desire to stay in a home state (perhaps because of family attachments) or the desire to be co-located with inventors active in the same technology area (perhaps because of learning opportunities). Our evidence shows inventors were significantly less likely to locate in states with higher taxes controlling for these other influences, suggesting that taxes would have shaped long-run economic development at the state level.

Taxes would have shaped long-run economic development at the state levele

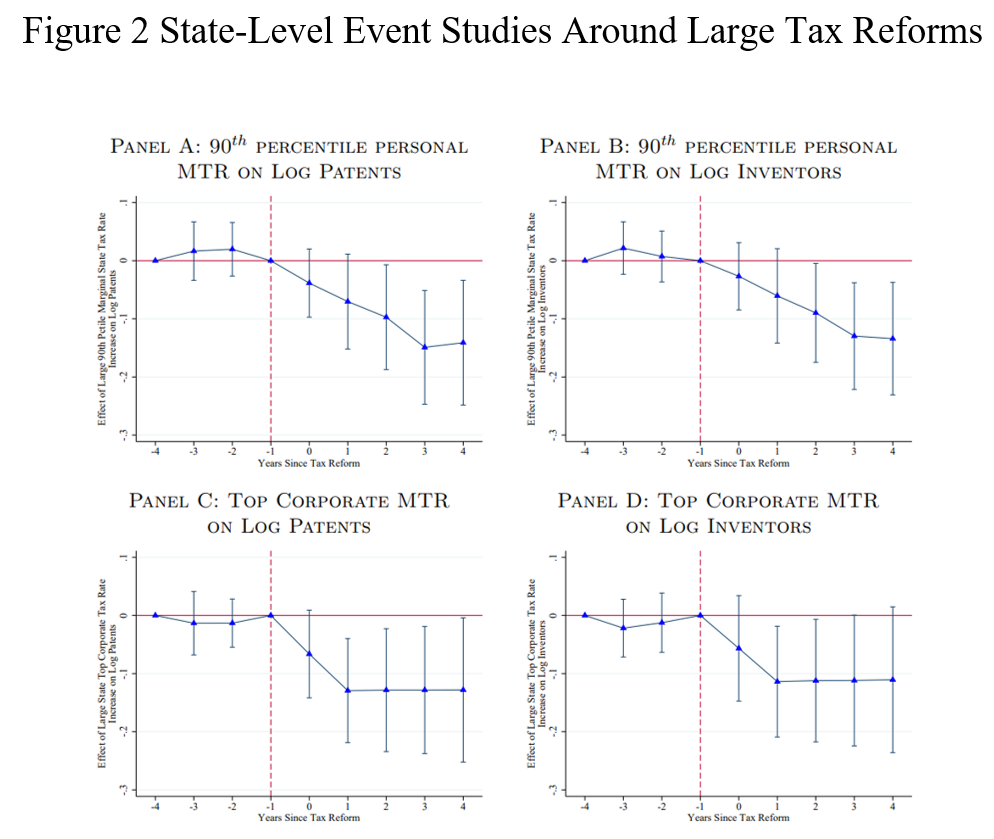

We also provide visual evidence on the impact of taxes by comparing innovative activity around large state tax reforms. Figure 2 compares innovation in states undergoing tax reforms relative to “synthetic control” states, which are defined as closely similar states not experiencing tax reforms. Prior to the reform, innovation paths are similar; after the reform, innovation decreases. These figures imply a corporate tax elasticity of 1.3 to 1.7 and a personal tax elasticity of 1.8 to 2.3. Both estimates bracket the main elasticities we find at the macro and micro levels, as described above.

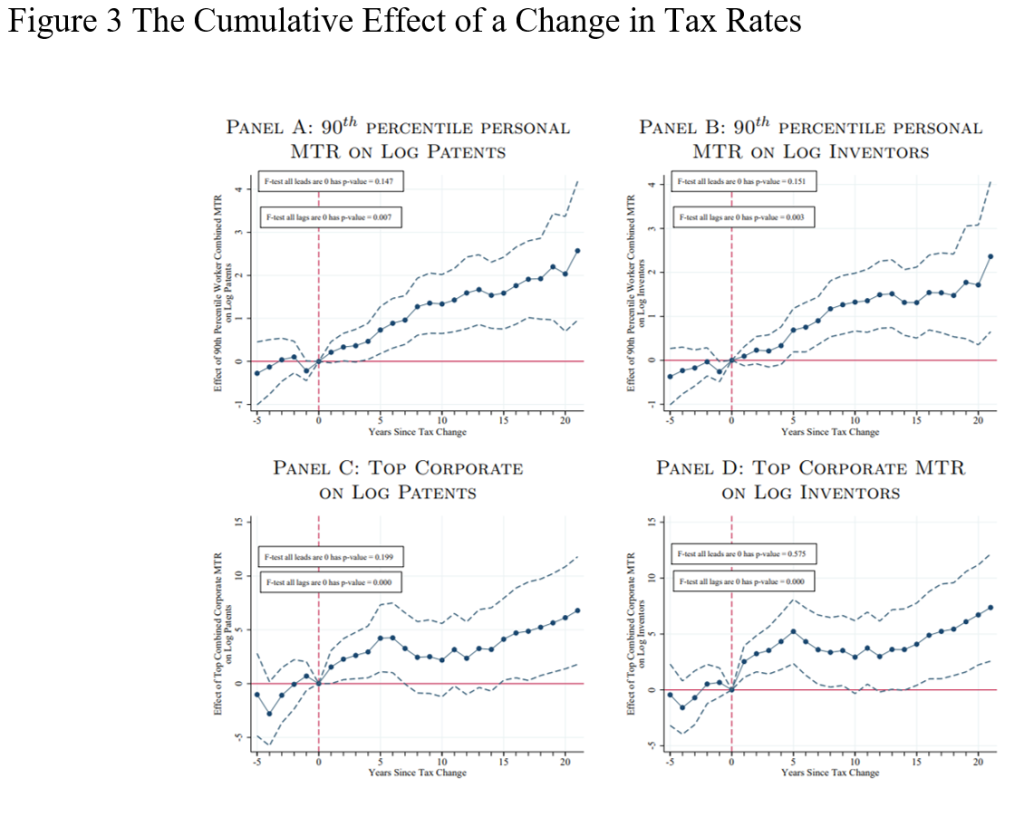

Finally, Figure 2 suggests the largest responses to tax changes occur around three to four years after a reform. To illustrate these dynamics further, Figure 3 shows the cumulative impact of tax changes on innovation at the state level for a time period up to two decades after the reform. Prior to tax reforms (which take place at time t=0 in these figures) there is no noticeable change in innovation, whereas after the reform the changes are clearly discernable. A one percent increase in the net-of-tax rate is associated with around a two percent increase in total patenting after 20 years for personal taxes, or as much as three to four percent for corporate taxes. Because the impact of taxes on innovation happens over time rather than all at once, our results suggest taxes can influence cumulative technological progress, which is a central feature of economic growth (e.g., Scotchmer, 1991; Galasso and Schankerman, 2015).

Policy Implications

Our analysis contributes to several policy discussions. First, optimal income tax models are guided by elasticities of earnings with respect to tax rates, especially in top income brackets (Pikety, Saez and Stantcheva, 2014). The most successful inventors tend to be high earners so it is important to understand their responses in order to successfully evaluate the impact of tax reforms. Part of that evaluation should focus on the mobility of inventors and the spatial dynamics of inventive activity. In our context, mobility effects approximately “zero-out” in aggregate at the macro-level within the US. Any international mobility of inventors in response to more generous tax incentives (Akcigit, Baslandze and Stantcheva, 2016) could, however, shift the global distribution of innovation.

General tax policy may be a useful complement to industrial policies where governments are looking to encourage economies of scale

Second, it has long been noted that the relationship between taxation and growth involves a tradeoff between marginal incentives and public goods provision (Aghion, Akcigit, Cagé and Kerr, 2016). Amenities like transport infrastructure or public universities, which are financed at least partially through tax revenues, can also influence the rate and direction of innovation. Indeed, we find smaller – but still economically meaningful – elasticities to taxes when controlling for agglomeration advantages. However, given the small gains the recent literature has estimated from industrial policies designed to encourage external economies of scale (Bartelme, Costinot, Donaldson, and Rodríguez-Clare, 2021), general tax policy may be a useful tool for determining where inventors choose to locate, which can then amplify the impact of technology clusters.

Finally, our study shows how extensive data collection efforts over the long run can inform tax policy by exploiting the richness of the evolution of the tax system over both time and geographic space in a research design that can exploit quasi-experimental variation for causal inference. If the impact of taxes on innovation involves dynamic responses, as we have shown, the relevant long-term effects can only be studied in historical perspective. In future work we hope to leverage additional historical datasets to study the effects of personal and corporate taxes on other key variables of interest to policy makers, such as output activity, productivity and inequality.

This article summarizes “Taxation and Innovation in the Twentieth Century” by Ufuk Akcigit, John Grigsby, Tom Nicholas, and Stefanie Stantcheva, published in the Quarterly Journal of Economics in February 2022.

Ufuk Akcigit is at the University of Chicago, the National Bureau of Economic Research, and the Centre for Economic Policy Research. John Grigsby is at Northwestern University. Tom Nicholas is at Harvard Business School. Stefanie Stantcheva is at Harvard University and the National Bureau of Economic Research, and the Centre for Economic Policy Research.