In many, many cases, people have a preference for working and doing business with those who share the same religious beliefs, come from the same geographic region, or have something else in common. If this preference arises from discrimination against other groups – if there is economically inefficient favoritism – the economy will not reach its full potential. But could there also be efficiency gains from transacting with people who are culturally proximate? If so, is it possible for the gains to be large enough to more than offset the losses from discrimination? Surprisingly, the answer to both questions is yes. However, that does not mean the barriers between groups should be reinforced. Policies that break down informational barriers between groups could produce further gains.

Development

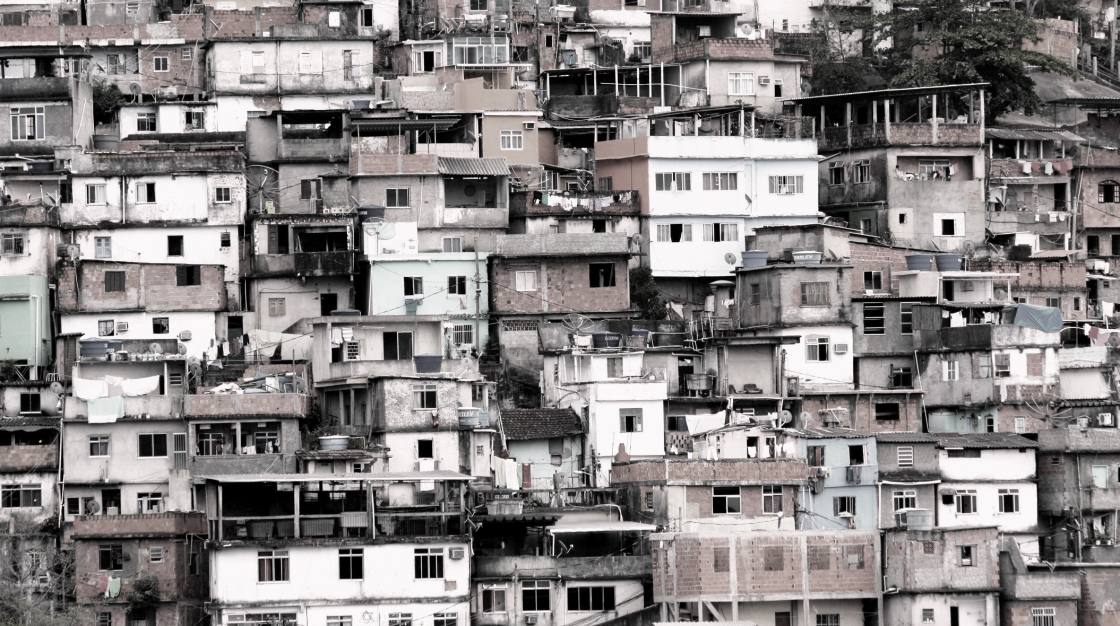

The majority of the world’s population lives in low-income countries where market failures are pervasive and governments’ budgets are tight. Research in development economics addresses the following questions:

What keeps individuals in poverty?

What keeps firms small and unable to expand?

Which policies have been effective at enabling resources to flow more easily to their most productive use, thus raising incomes?

What approaches have been effective at improving government performance, e.g. through incentives for agents delivering public services and the design of the tax system?

Latest articles

Absolute poverty: when necessity displaces desire

The number of people living in poverty in countries around the world is commonly measured using the World Bank’s poverty line – the ‘$1 per day’ that many people have heard of, though it has risen over time and now stands at $1.90 per day. However this measure assumes that the needs of the poor are the same in every country, an assumption at odds with the evidence and common sense. This paper develops a Basic Needs Poverty Line that overcomes this problem giving us new and in some cases surprising insight into the severity of the poverty problem in both rich and poor countries around the world.

Economic benefits of transportation infrastructure: historical evidence from India and America

Dave Donaldson is an empirical trade economist and recipient of the 2017 John Bates Clark Medal. His research examines the intersection of international trade and development economics. Donaldson’s paper “Railroads of the Raj: Estimating the Impact of Transportation Infrastructure?” (American Economic Review, forthcoming) investigates the economic benefits from building transportation infrastructure studying the case of railways in 19th century India. This paper is widely viewed as both a methodological breakthrough and substantively important paper in the field. The article below provides a summary of his work.

Impact of incentives on tax collectors and taxpayers

Tax collectors in developing countries collect far less tax revenue as a share of gross domestic product than tax collectors in higher income countries. In many of these developing countries, tax officials have discretion in assessing, enforcing, and auditing taxes. In addition, they earn relatively low wages with fewer rewards for good performance, allowing for the possibility of collusion with taxpayers. In the case of property taxes, officials may accept payments in exchange for leaving properties off the tax rolls, granting inappropriate exemptions, or assessing properties at a lower rate, all of which lead to lower revenues for the state.

Designing tax policy in high-evasion economies

Developing economies are typically characterized by low tax revenue and widespread tax evasion. This research shows that in such environments, it can be better to tax firms based on turnover rather than profits: while turnover taxes are known to distort production decisions, they are more difficult to evade than profit taxes. Analyzing administrative tax records from Pakistan, the study shows that the use of production-inefficient turnover taxes sharply reduces tax evasion and increases tax revenue.

Why is labor mobility in India so low?

Migration from rural areas of India to the city is surprisingly low compared with other large developing countries, leaving higher paying job opportunities unexploited. This research shows that well-functioning rural insurance networks are in part responsible for this misallocation in the labor market, creating incentives that keep adult males in the village. Policies that provide private credit to wealthy households or government safety nets to poor households would encourage greater rural-urban migration but they could also have unintended distributional consequences.

Climate change: the potential impact on global agricultural markets

Many fear that climate change will have severe effects on the global economy, particularly through the threat to food production and farmers’ earnings. This research suggests that much of the potential harm could be avoided if farmers can switch their crops in response to changing relative yields.