How much does consuming news with a strong political slant influence Americans’ votes in presidential elections? And how strongly do people prefer news sources that are slanted towards their own political preferences? This research provides evidence on the persuasive effects of slanted news and viewers’ tastes for like-minded news by analyzing data on the three big US cable news channels: CNN, Fox News, and MSNBC. The results indicate that these news sources – and Fox News in particular – have the potential for large effects on the outcomes of elections.

Organisation of Markets

We focus on research that concerns antitrust policy, economic regulation, and market design. Questions of interest include the following:

How should we regulate horizontal and/or vertical mergers? Is there a trade-off between short run market power and longer run investment incentives?

How should we respond to departures from the competitive ideal in markets; with imperfect information, that are highly concentrated, that are natural monopolies, or that generate externalities resulting from knowledge producing activities?

How should centralized markets (like health insurance exchanges, kidney exchanges, and school choice mechanisms) be organized?

What is the optimal design of auctions to procure services for the government, such as highway construction contracts, or to sell government assets, such as spectrum or mineral rights?

How can policy makers detect and deter collusion?

How should patent policy be designed?

Latest articles

US Treasury auctions: measuring the effectiveness of primary markets for government securities

How should government bonds be sold? Research typically emphasizes how the auction design affects outcomes depending on the nature of demand and the competitive environment. This study combines models of strategic bidding in Treasury auctions with detailed bidding data to construct empirical measures that reveal the effectiveness of auctions. Applying these methods to data on US Treasury auctions shows that the gains from optimizing the auction mechanism are no more than 5 basis points. The research also quantifies the advantage enjoyed by primary dealers in these markets, who are able to observe the ‘willingness-to-pay’ of their customers who route their bids through them.

The effects of coordinating school assignments through a centralized mechanism

Matching theory, which examines what happens when one or more types of searchers interact, has proven to be a powerful tool for increasing the efficiency of markets where mutual consent is required. The process of matching employers with job seekers, pairing suitable romantic partners, and even finding compatible kidney donors and recipients has been enhanced through the application of this theory. Today, school admissions processes are being redesigned using matching theory, but the outcome of this innovation has received less analysis.

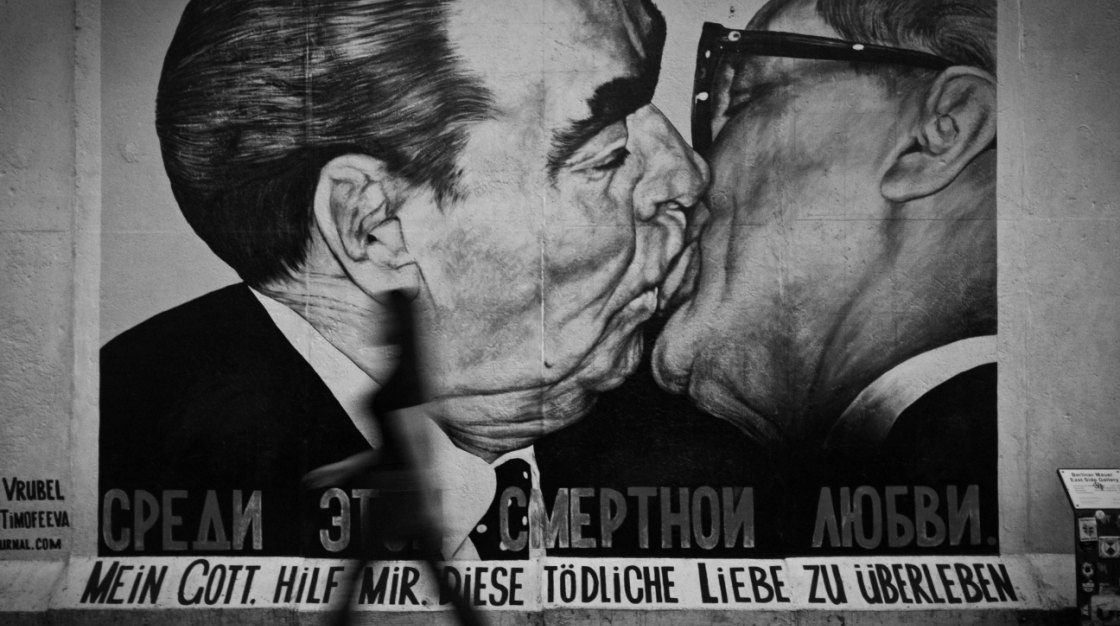

The economics of density: evidence from the Berlin Wall

The Berlin Wall provides a unique natural experiment for identifying the key sources of urban development. This research, for which its authors have recently been awarded the prestigious Frisch Medal, shows how property prices and economic activity in the east side of West Berlin, close to the historic central business district in East Berlin, began to fall when the city was divided; then, during the 1990s, after reunification, the same area began to redevelop. Theory and empirical evidence confirm the positive relationship between urban density and productivity in a virtuous circle of ‘cumulative causation’. The analysis has practical applications for urban planners making decisions on housing and transport infrastructure.

The career cost of children: career and fertility trade-offs

Women are often paid less than men, they are often underrepresented in leading positions, and their careers develop at a slower pace than those of men. Here, we ask to what extent these differences can be explained by childbearing. To evaluate the career cost associated with having children, we consider women’s decisions regarding labor supply, occupation, fertility and savings. We evaluate the life-cycle career cost of children to be equivalent to 35 percent of a woman’s total earnings. We further show that part of this cost arises well before children are born through selection into careers characterized by lower wages but also lower skill depreciation.

Cultural proximity and loans

In many, many cases, people have a preference for working and doing business with those who share the same religious beliefs, come from the same geographic region, or have something else in common. If this preference arises from discrimination against other groups – if there is economically inefficient favoritism – the economy will not reach its full potential. But could there also be efficiency gains from transacting with people who are culturally proximate? If so, is it possible for the gains to be large enough to more than offset the losses from discrimination? Surprisingly, the answer to both questions is yes. However, that does not mean the barriers between groups should be reinforced. Policies that break down informational barriers between groups could produce further gains.

Infrastructure investment and regulation: evidence from the US electricity distribution sector

Regulated utilities are tasked with investing in the electricity distribution system in a way that delivers a reliable power service. This research explains how the regulatory process in the United States leads to under-investment in such infrastructure and too many power outages. The findings show how the politics of the regulatory environment can sometimes help and sometimes harm the problem of under-investment.

How the MillerCoors joint venture changed competition in U.S. brewing

This paper studies the aftermath of the MillerCoors joint venture, which merged the operations of SAB Miller and Molson Coors in the United States. The prices of MillerCoors and its biggest rival, Anheuser-Busch Inbev, increased after the joint venture was consummated. These changes are consistent with post-merger coordination between MillerCoors and Anheuser-Busch Inbev.

Opportunity and access: how legal work status affects immigrant crime rates

Immigration policy continues to be a hotly debated issue in many developed countries around the world. A contentious point cited by many policymakers relates to the high crime rates of immigrants relative to the native population. How does work status and legal access to the labor market affect the crime rates of immigrants? This article summarizes recent research from Pinotti (2017) on the Italian immigration system and finds that a lack of legal work opportunities for immigrants contributes to higher rates of immigrant crime.

Does arbitrage always improve market efficiency? Theory and evidence from sequential markets for electricity

Since the 1990s, many countries have deregulated their electricity markets. Electricity producers and distributors participate in auctions in forward and spot markets, which determine production allocation and wholesale prices. A key policy question for the United States and the rest of the world is whether financial traders should be allowed to participate in the auctions to arbitrage differences between forward and spot prices. Does arbitrage benefit consumers? Does it lead to more efficient allocation of production resources? This article summarises Ito and Reguant (2016), and address those questions from theoretical and empirical perspectives by examining the Iberian electricity market.