How should government bonds be sold? Research typically emphasizes how the auction design affects outcomes depending on the nature of demand and the competitive environment. This study combines models of strategic bidding in Treasury auctions with detailed bidding data to construct empirical measures that reveal the effectiveness of auctions. Applying these methods to data on US Treasury auctions shows that the gains from optimizing the auction mechanism are no more than 5 basis points. The research also quantifies the advantage enjoyed by primary dealers in these markets, who are able to observe the ‘willingness-to-pay’ of their customers who route their bids through them.

The effects of coordinating school assignments through a centralized mechanism

Matching theory, which examines what happens when one or more types of searchers interact, has proven to be a powerful tool for increasing the efficiency of markets where mutual consent is required. The process of matching employers with job seekers, pairing suitable romantic partners, and even finding compatible kidney donors and recipients has been enhanced through the application of this theory. Today, school admissions processes are being redesigned using matching theory, but the outcome of this innovation has received less analysis.

The impact of protection on trade: lessons from Britain’s 1930s policy shift

With protectionist pressures rising and the multilateral trading system seemingly at risk, it is natural to look to the 1930s for evidence of how protection affects the volume and pattern of trade. This column examines the impact of Britain’s decisive break with a longstanding tradition of free trade in 1931, when the country switched dramatically to a policy of protection, discriminating in favor of the British Empire. The shift explains roughly a quarter of Britain’s trade collapse, and around three quarters of the big increase in the British Empire’s share of British imports during the 1930s.

Growth and well-being: policy should not be based on GDP alone

Economists are often accused of focusing excessively on GDP, with the result that government policies make GDP a priority to the detriment of other contributors to well-being. This research proposes a broader summary statistic that incorporates consumption, leisure, mortality and inequality. While the new statistic is highly correlated with GDP per capita, cross-national deviations are often large: Western Europe looks considerably closer to the United States; emerging Asia has not caught up as much; and many developing countries are further behind. Each component of the statistic plays a significant role in explaining these differences, with mortality being the most important. While still imperfect, the statistic arguably provides better guidance for determining public priorities and evaluating policies than does GDP alone.

Regional variation in US healthcare use: evidence from patient migration

There is considerable geographical variation in the use of healthcare by beneficiaries of Medicare, the US federal health insurance program for people who are 65 or older. This research explores the extent to which regional disparities are driven by the providers, whose use of expensive tests or procedures might vary across different places, or by the patients, who might have different healthcare needs and preferences. Analyzing data on Medicare beneficiaries who have migrated from one part of the country to another, the study finds that patients and providers account for roughly equal shares of the differences in regional spending. The results provide a better understanding of the components of medical costs, adding nuance to the debate about possible inefficiencies in US healthcare spending.

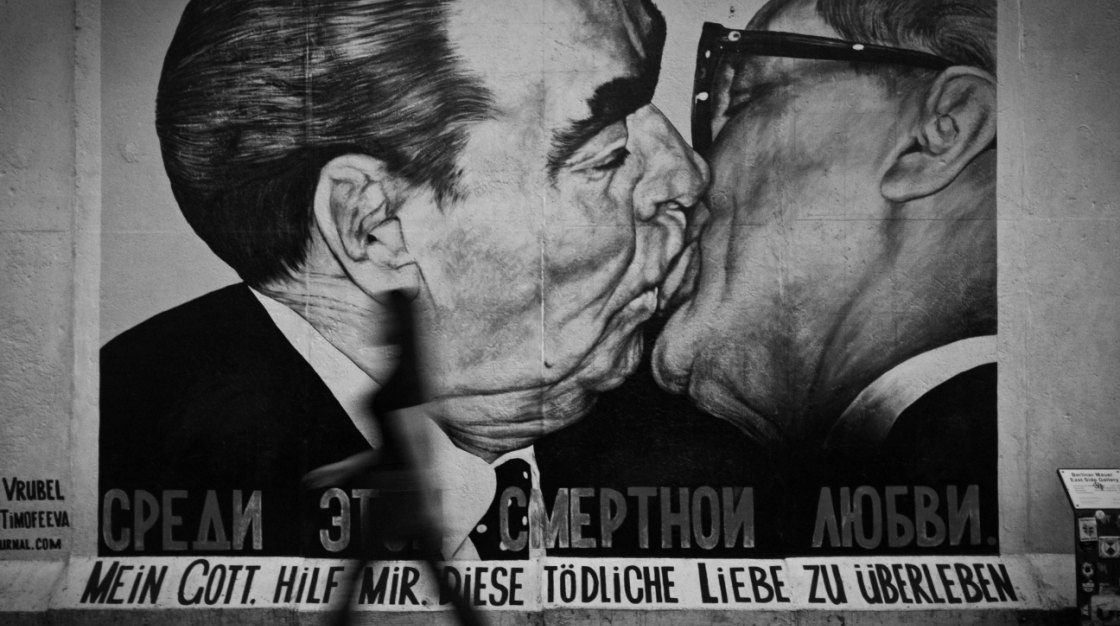

The economics of density: evidence from the Berlin Wall

The Berlin Wall provides a unique natural experiment for identifying the key sources of urban development. This research, for which its authors have recently been awarded the prestigious Frisch Medal, shows how property prices and economic activity in the east side of West Berlin, close to the historic central business district in East Berlin, began to fall when the city was divided; then, during the 1990s, after reunification, the same area began to redevelop. Theory and empirical evidence confirm the positive relationship between urban density and productivity in a virtuous circle of ‘cumulative causation’. The analysis has practical applications for urban planners making decisions on housing and transport infrastructure.

US manufacturing jobs and trade liberalization with China

Trade relations between the United States and China have grown increasingly tense, spurred by concerns that growing imports from China have led to plant closures and job loss in the United States. We find a link between the sharp decline in U.S. manufacturing employment after 2000 and the granting of Permanent Normal Trade Relations (PNTR) to China, which eliminated uncertainty about China‘s continued access to the U.S. market. Our research into the reactions of U.S. and Chinese firms to PNTR highlights the sensitivity of firm behavior to policy uncertainty.

The career cost of children: career and fertility trade-offs

Women are often paid less than men, they are often underrepresented in leading positions, and their careers develop at a slower pace than those of men. Here, we ask to what extent these differences can be explained by childbearing. To evaluate the career cost associated with having children, we consider women’s decisions regarding labor supply, occupation, fertility and savings. We evaluate the life-cycle career cost of children to be equivalent to 35 percent of a woman’s total earnings. We further show that part of this cost arises well before children are born through selection into careers characterized by lower wages but also lower skill depreciation.

Cultural proximity and loans

In many, many cases, people have a preference for working and doing business with those who share the same religious beliefs, come from the same geographic region, or have something else in common. If this preference arises from discrimination against other groups – if there is economically inefficient favoritism – the economy will not reach its full potential. But could there also be efficiency gains from transacting with people who are culturally proximate? If so, is it possible for the gains to be large enough to more than offset the losses from discrimination? Surprisingly, the answer to both questions is yes. However, that does not mean the barriers between groups should be reinforced. Policies that break down informational barriers between groups could produce further gains.

Do larger health insurance subsidies benefit patients or producers? Evidence from Medicare Advantage

A central question in the US debate over privatized Medicare is whether increased government contributions to private plans generate lower premiums for consumers or higher profits for producers. This research finds that insurance companies pass through 45% of higher payments in lower premiums and an additional 9% in more generous benefits for those who enroll in Medicare Advantage. Since the findings also suggest that the less than full pass-through is a result of insurer market power, efforts to make markets more competitive may be key to increasing the pass-through to consumers.