Our study explores the importance of these two factors – technological innovation and regulatory arbitrage – in the New York City taxi market. Our study is part of an emerging body of research in economics that explores the implications of technological change in the transport sector. Another notable study that complements ours is by Nick […]

Organisation of Markets

We focus on research that concerns antitrust policy, economic regulation, and market design. Questions of interest include the following:

How should we regulate horizontal and/or vertical mergers? Is there a trade-off between short run market power and longer run investment incentives?

How should we respond to departures from the competitive ideal in markets; with imperfect information, that are highly concentrated, that are natural monopolies, or that generate externalities resulting from knowledge producing activities?

How should centralized markets (like health insurance exchanges, kidney exchanges, and school choice mechanisms) be organized?

What is the optimal design of auctions to procure services for the government, such as highway construction contracts, or to sell government assets, such as spectrum or mineral rights?

How can policy makers detect and deter collusion?

How should patent policy be designed?

Latest articles

Who benefits from rent control? Evidence from San Francisco

In 2019, Oregon and California became the first states to pass statewide rent control. Lawmakers in other states, including Colorado and Illinois, are considering repealing laws that limit cities’ abilities to pass or expand rent control. Rent control is already extremely popular around the San Francisco Bay Area: nine cities already impose rent control regulations, […]

Effects of vertical mergers in multichannel TV markets: evidence from regional sports programming

So-called ‘vertical’ mergers between producers of TV channels and distributors of those channels are regular – and sometimes highly contested – events, both in the United States and elsewhere in the world. The attention that such mergers have attracted is partly due to the industry’s overwhelming reach and size: over 80% of the approximately 120 […]

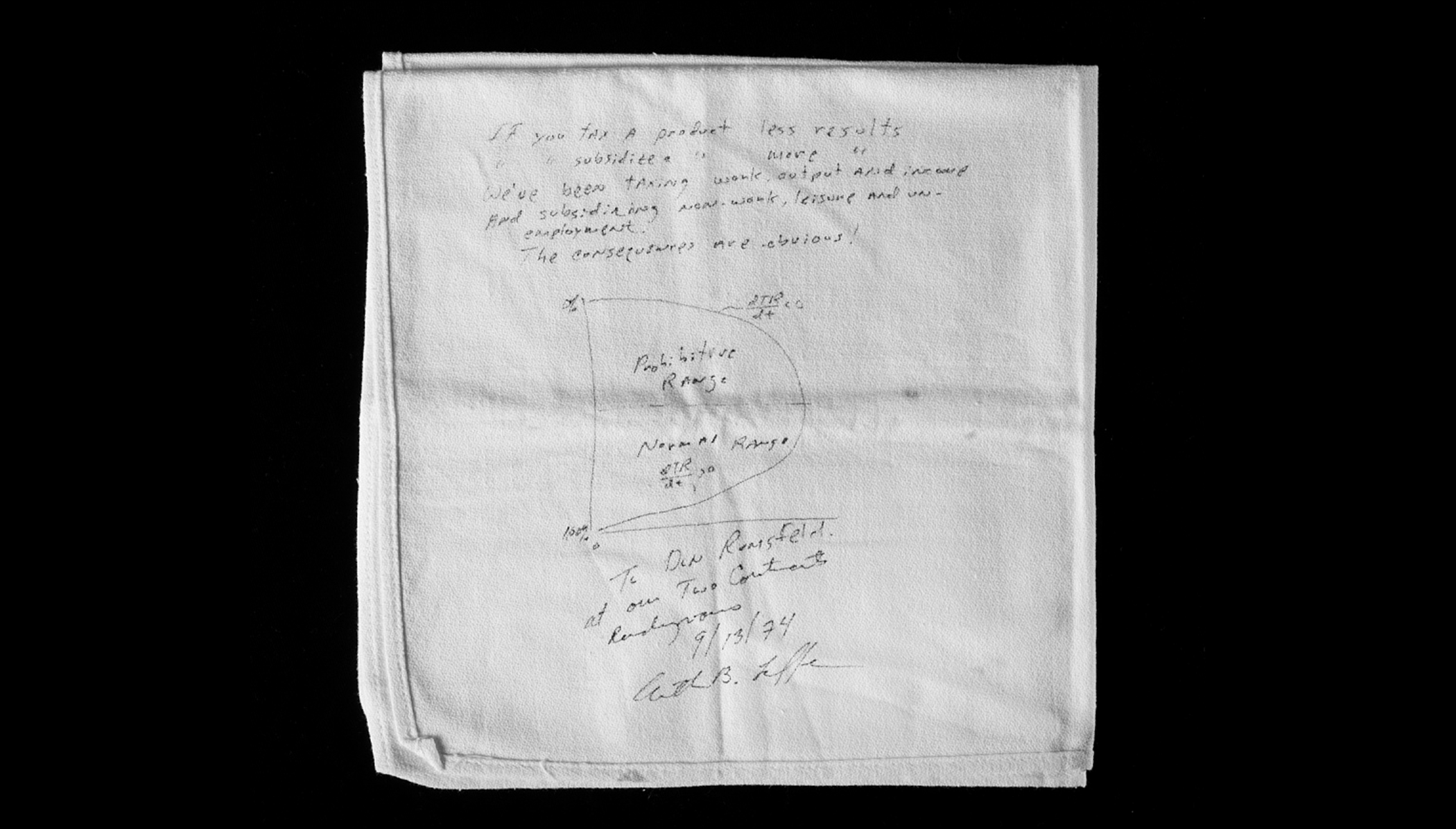

Market power and the Laffer curve

Arthur Laffer, who was recently awarded the Presidential Medal of Freedom, is famous for sketching an inverted U-shaped diagram of the supposed trade-off between tax rates and tax revenues. The Laffer curve helps to characterize how firms as well as consumers respond to tax changes, and this research uses it to evaluate whether commodity taxes are an effective tool for financing government expenditure. Applying the idea to taxation of distilled spirits in Pennsylvania, where retail sales only take place through a state-run monopoly, the study shows how firms with market power change their pricing when taxes are cut and what that implies for state tax revenues.

How management practices drive firms’ performance in the long run: evidence from the Marshall Plan

Economists have long speculated about why there are large differences in productivity across both firms and countries. One explanation is that they reflect variation in management practices, which raises the question of whether management training can improve firms’ performance. This research examines the long-run effects of such training, using evidence from the US Productivity Program […]

The value of international business relationships: insights from Kenya’s rose exporters

Globalization gives producers in developing countries the opportunity to serve larger, richer, and more demanding foreign markets. But between these producers and potential consumers in the West sit large buyers, such as Carrefour, H&M, Tesco, and Walmart, with whom business relationships must be negotiated. Due to the large opportunity costs of time and shelf space, […]

The incentives of centralized school admissions systems

Many school districts have adopted centralized admissions systems to coordinate student assignments. These systems ask students to rank the schools they would like to attend and then use an algorithm to coordinate placement. These algorithms consider student preferences, eligibility criteria and school capacities. In order to better understand student preferences and the performance of various systems, this study develops a general methodology to analyze the reports on student preferences submitted to school choice systems.

Bias in cable news

How much does consuming news with a strong political slant influence Americans’ votes in presidential elections? And how strongly do people prefer news sources that are slanted towards their own political preferences? This research provides evidence on the persuasive effects of slanted news and viewers’ tastes for like-minded news by analyzing data on the three big US cable news channels: CNN, Fox News, and MSNBC. The results indicate that these news sources – and Fox News in particular – have the potential for large effects on the outcomes of elections.

US Treasury auctions: measuring the effectiveness of primary markets for government securities

How should government bonds be sold? Research typically emphasizes how the auction design affects outcomes depending on the nature of demand and the competitive environment. This study combines models of strategic bidding in Treasury auctions with detailed bidding data to construct empirical measures that reveal the effectiveness of auctions. Applying these methods to data on US Treasury auctions shows that the gains from optimizing the auction mechanism are no more than 5 basis points. The research also quantifies the advantage enjoyed by primary dealers in these markets, who are able to observe the ‘willingness-to-pay’ of their customers who route their bids through them.

The effects of coordinating school assignments through a centralized mechanism

Matching theory, which examines what happens when one or more types of searchers interact, has proven to be a powerful tool for increasing the efficiency of markets where mutual consent is required. The process of matching employers with job seekers, pairing suitable romantic partners, and even finding compatible kidney donors and recipients has been enhanced through the application of this theory. Today, school admissions processes are being redesigned using matching theory, but the outcome of this innovation has received less analysis.